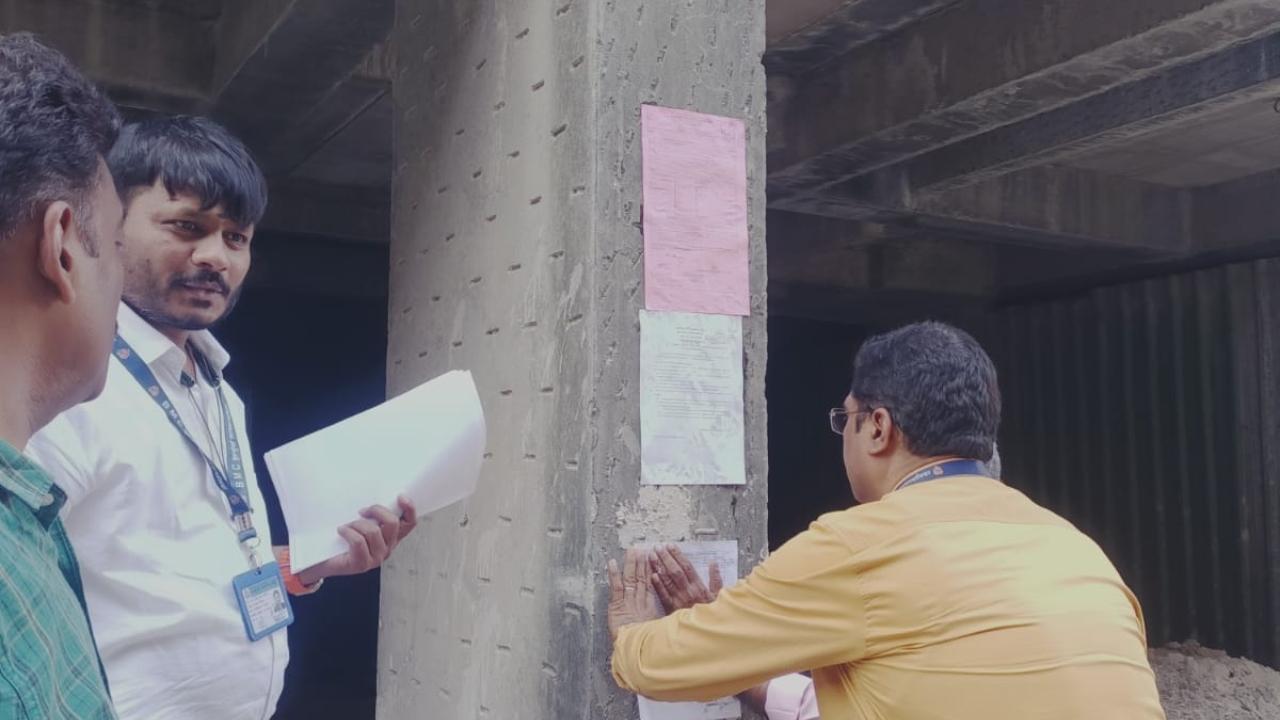

The civic body launched strict action against the reality firm for failing to pay property taxes on its 18 properties in Chandivali, an official statement said

The BMC is taking strict measures against big tax defaulters, the officials said

The Brihanmumbai Municipal Corporation (BMC) on Friday said that it has attached at least 18 properties worth Rs 178.64 crore in Chandivali of of Mumbai for allegedly not paying property taxes.

An official statement said that the civic body launched strict action against the reality firm for failing to pay property taxes on its 18 properties in Chandivali.

"The total amount of the properties is worth around Rs 178.64 crore," an official statement said, adding the company has been given a notice to pay the dues within 21 days, or the properties will be auctioned.

The statement said that despite repeated reminders and efforts from the BMC’s tax assessment and collection department, the company allegedly failed to pay its dues, leading to the attachment of its properties.

The BMC is taking strict measures against big tax defaulters, including seizure and auctioning of properties, it said.

It further said that the properties include land, residential and commercial buildings, shops, and industrial spaces. The BMC has attached these properties under the relevant legal sections, and if the dues are not cleared within the given time, the authorities will begin the auction process.

The Brihanmumbai Municipal Commissioner Bhushan Gagrani and Additional Municipal Commissioner (City) Dr. Ashwini Joshi have directed the BMC’s tax department to ensure timely tax collection. Assistant Commissioner (Tax Assessment and Collection) Vishwas Shankarwar is overseeing the process, the statement said.

The BMC has set a target of collecting Rs. 6,200 crore in property taxes for the fiscal year 2024-25. So far, Rs. 4,823 crore has been collected, with an outstanding target of Rs. 1,377 crore to be met by March 31, 2025.

The civic body has warned the property owners who delay BMC property tax payments to pay within the specified time to avoid penalties followed by a legal action against non-payment of the taxes.

As part of the official process, for defaulters, the BMC has issued legal notices under Section 203, and if the tax is not paid, the properties will be auctioned as per the rules outlined in Sections 203, 204, 205, and 206 of the Mumbai Municipal Corporation Act, the statement said.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!