Behaving as expected and staying on course through the week; all eyes on forthcoming elections

The week gone by behaved exactly as expected and gained on four of the five trading days. The correction on Thursday was severe and very welcome for a rally which has been quite strong. All in all, a rally of between 1.7 to 2 per cent is quite alright for the week. The SENSEX gained 333.93 points or 1.64 per cent to close at 20,700.75 points.

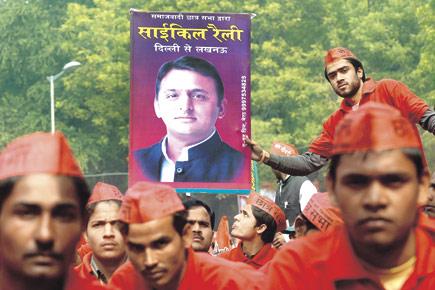

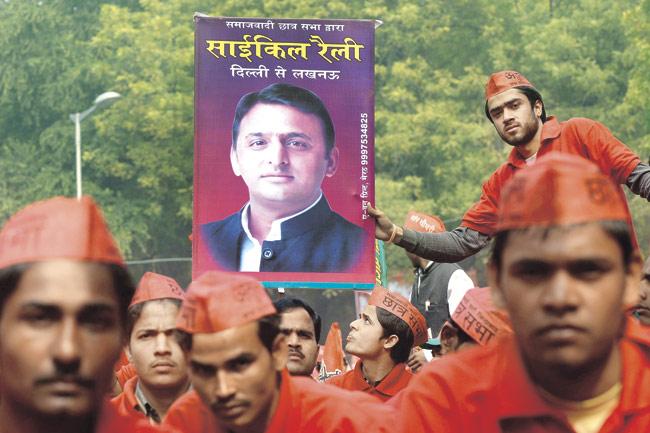

A supporter holds up a portrait of UP CM Akhilesh Yadav during a Samajwadi Party election campaign. The bicycle rally, will run for two weeks as campaigners cycle from New Delhi to Lucknow. Pic/AFP

The NIFTY gained 107.10 points or 1.77 per cent at 6,155.45 points. The BSE100, BSE200 and BSE500 gained 1.73 per cent, 1.69 per cent and 1.72 per cent respectively. The BSEMIDCAP gained 1.75 per cent while the BSESMALLCAP gained 1.81 per cent.

The top sectoral gainer was BSECAP GOODS up 4.66 per cent followed by BSEBANKEX up 3.36 per cent and BSEPOWER up 2.83 per cent. The losers were led by BSEMETAL down 0.92 per cent. The other losers included BSEOIL GAS down 0.42 per cent and BSEFMCG down 0.30 per cent.

Gainer

In individual stocks, the biggest gainer was Axis Bank up 7.89 per cent followed by Hind Petro up 7.39 per cent and L&T up 5.94 per cent. The losers were led by Bharti Tele down 5.57 per cent. Other losers included Coal India down 3.59 per cent and Bank of Baroda down 3.33 per cent.

The markets have done well last week and this is in the backdrop of world markets doing nothing much. The Dow Jones closed virtually flat at 16,103.30 points down 51.09 points or 0.31 per cent. FIIs were buyers of equities of Rs 2,046.61 crore for the week while domestic institutions were sellers of equities worth Rs 1,133.55 crore. The Indian Rupee lost Rs 0.20 to close at Rs 62.12.

Trajectory

This week has a trading holiday on Thursday and hence expiry for February series would take place a day earlier on Wednesday, February 26. The markets will continue to move up as we get closer to the elections. The previous series had expired at a level of 6,073 points.

The current level is higher by 70 points or 1.34 per cent. Open interest is fairly low and there is a great deal of skepticism in the market of the election throwing up a mixed verdict. If one were to take a current opinion poll amongst market participants those expecting a hung parliament would be in the majority.

It is this fear that is keeping the markets tied down. However with FIIs turning bullish, it's a matter of time before the view will start changing. The higher the index, the higher the belief of a clear mandate and the lower the index, the stronger the conviction of a hung parliament.

Telengana

A new state Telengana has been created after bifurcating Andhra Pradesh into Telengana and Seemandhra. The split has been quite melodramatic and also bizarre. It is for the first time since Lok Sabha TV has been introduced that the entire debate of the statehood was blacked out and we had a first in "Pepper Spray" being used by a MP.

The CM of the state of AP has quit the post and resigned from the Congress party. It would be an irony that the ruling government had its largest contingent of elected members from AP in the outgoing house and expects to do the same this time from Telengana. The catch is that Telengana state post bifurcation will have a mere 17 seats.

Before being dissolved, Parliament passed the vote on account which had a pleasant surprise in reduction of across the board cuts in excise duties on two-wheelers and four-wheelers including SUVs. The cut is welcome, considering the fact that with elections a mere couple of months away the sale of SUVs would increase for the comfort of politicians using these vehicles in the campaign trail.

Elections

The week ahead would be driven by news flow from overseas and the action from FIIs. With expiry, a trading holiday and low interest in the market sharp moves can happen easily.

I believe with so much of scepticism on the election outcome, markets will continue to rally. Sharp upmove is in the offing probably at the beginning of the new settlement or the new month. Key levels for the SENSEX are 20,325 and 21,025 while they are 6,060 and 6,225 for the NIFTY.

The support for the SENSEX is at 20,625 points, then at 20,442 points, then at 20,149 points, than at 20,031 points and finally at 19,965 points. It has resistance at 20,750 points, then at 20,875 points, then at 20,999 points, then at 21,185 points and finally at 21,265 points.

The NIFTY has support at 6,122 points, then at 6,072 points, then at 6,005 points, then at 5,969 points and finally at 5,933 points. It has resistance at 6,174 points, then at 6,195 points, then at 6,244 points, then at 6,306 points and finally at 6,345 points. There may be different views than mine about the market but if in doubt, stay away do not short.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd. Readers are invited to read more about these and other issues on his website https://ak57.in

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only and under no circumstances should be used for actual trading or making investment decisions. Readers must consult a qualified financial advisor prior to making any actual investment or trading decisions, based on information published here.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!