From desperate families with joint accounts, to those who were saving for children’s education or weddings, depositors throng New India Co-Operative Bank branches, which are only allowing them access to their lockers

Customers at New India Co-operative Bank in Kandivli after RBI imposed strict withdrawal restrictions on the bank on Friday. Pic/Nimesh Dave

Panic gripped customers of New India Co-operative Bank after the Reserve Bank of India (RBI) imposed severe restrictions on withdrawals for six months due to concerns over the bank’s financial stability. While customers are allowed to access their lockers to retrieve valuables, bank officials have provided no clarity on the situation. Large crowds gathered outside bank branches across the city after the news spread on social media. Customers told mid-day they no longer feel safe keeping money in banks, as their lifetime savings are now locked inside the bank.

Customers rush to the New India Co-op Bank in Andheri after strict withdrawal curbs on Friday

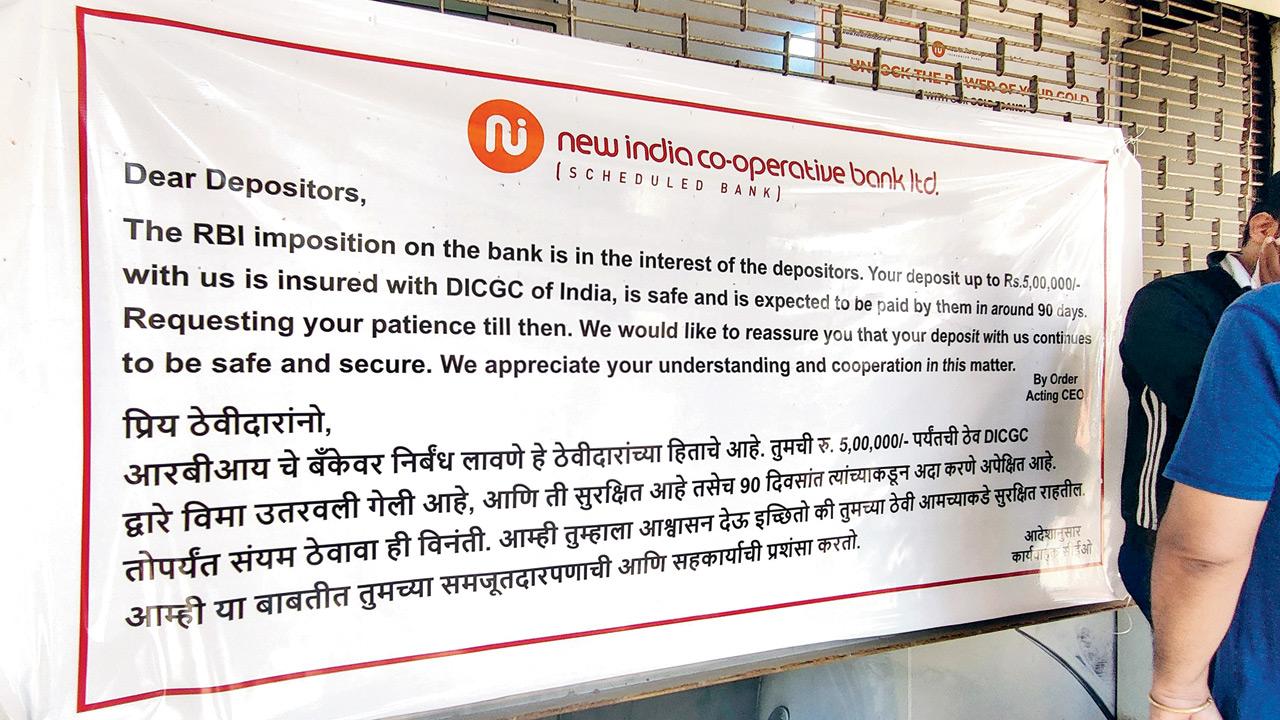

At all branches, the bank put up notices stating:

“Dear Depositors, the RBI’s restrictions are in the interest of depositors. Deposits up to R5 lakh are insured with the Deposit Insurance and Credit Guarantee Corporation (DICGC) and are expected to be paid within 90 days. We assure you that your money remains safe. We appreciate your patience and cooperation. — Order by Acting CEO.”

Customer distress

At the Borivli West branch, Chirag Dedhia and his wife Forum Dedhia said. “We opened a joint savings account here seven years ago. This morning, we heard something was wrong and rushed to our branch. The bank isn’t allowing withdrawals. We can’t trust any bank anymore—our entire savings are stuck.”

Shital Shah, a Kandivli resident, said, “I have over Rs 20 lakh in fixed deposits and R5 lakh in my savings account. I saved this money for my children’s future. Now, it’s all stuck.” Keyur Goghri, a Borivli resident, added, “My entire family has savings in this bank, over R5 lakh. Suddenly, this morning, we were told the bank is shutting down transactions.”

Notice put up outside the bank. Pics/Nimesh Dave

At the Mulund West branch, retired fire officer Ashok Bhosale was in distress. “I kept R15 lakh here for my daughter’s wedding. The bank says R5 lakh will be released, but when? What about the rest? This is a financial disaster.” Deepak Patel, a daily-wage driver, said, “I saved for my sister’s wedding in May. My family depends on me, and now my money is stuck. I am helpless. The RBI must intervene.”

Political reaction

NCP-SP (Sharad Pawar faction) spokesperson, Sardar Gurjyot Singh Keer (Guru), criticised the lack of action. “The RBI issued the notice at 9 am, and it circulated online, yet the Mumbai police have done nothing. We have petitioned the Supreme Court to form a Special Investigation Team (SIT) to probe this scam. Even PMC Bank victims haven’t received their money back yet.”

RBI’s stance

The RBI clarified that the restrictions under Section 35A and 56 of the Banking Regulation Act were imposed due to supervisory concerns and to protect depositors’ interests.

The directive prohibits the bank from issuing loans, renewing deposits, or disbursing funds without RBI approval. However, depositors can claim up to Rs 5 lakh through the Deposit Insurance and Credit Guarantee Corporation (DICGC) after due verification.

The RBI emphasised that the bank’s license has not been cancelled, and operations will continue under strict monitoring. The restrictions are in force for six months, subject to review.

Financial expert speaks

Financial expert Mitil Chokshi has raised concerns over the crisis at New India Cooperative Bank, questioning the absence of warning signs leading up to the current situation. “What worries me is that there were no staged red flags. Why weren’t there any? Regulators conduct inspections, and while I am not blaming them, the issue is that no warnings were gradually escalated over time. Why has this crisis suddenly surfaced?”

Chokshi also pointed out broader challenges within the cooperative banking sector, which was supposed to be restructured but continues to struggle with systemic issues. “The cooperative sector was meant to be streamlined, yet it remains unorganised. The government’s goal was to rationalise the sector, but instead, it is competing with large and mid-sized banks. This competition is problematic, and a clear strategic direction for the cooperative sector is urgently needed.”

He also cited past financial crises, such as NSEL and PMC Bank, as cautionary examples. “Unless there is a significant revaluation of investments—like in the Franklin Templeton case, where revaluation prevented losses—depositors could face major setbacks. These are the critical risks in such situations,” he said.

As the situation unfolds, Chokshi expects the RBI to step in by appointing an administrator. “The RBI is likely reassessing its options. In cooperative banking crises, an administrator is typically appointed to evaluate assets and liabilities, plan distribution, and prioritise smaller depositors while utilising assets to reduce liabilities.” He further highlighted the ongoing stress in the microfinance sector, which plays a crucial role in cooperative banking.

“Many cooperative banks primarily issue microfinance loans, and the industry is under pressure across India. New India Cooperative Bank is no exception. A comprehensive revamp of the cooperative banking sector is the need of the hour,” Chokshi added.

Regarding depositors’ concerns, Chokshi emphasised key financial uncertainties:

>> It remains unclear whether withdrawals beyond Rs 5 lakh will be allowed.

>> The extent of DICGC insurance coverage needs to be clarified.

>> Payouts will likely be staggered, with smaller depositors (holding up to R5–10 lakh) expected to recover their funds. However, those with deposits exceeding Rs 10 lakh face uncertainty.

Mumbai police’s EOW has launched an investigation into alleged irregularities at New India Cooperative Bank. A bank representative has filed a complaint with the EOW, which is currently recording their statement. The EOW is working to determine what went wrong and where the alleged discrepancies occurred. Sources say further legal action will be taken after the statement is recorded.

Voices

Chirag and his wife Forum Dedhia, Borivli resident

‘We opened a joint savings account here seven years ago. This morning, we heard something was wrong and rushed to our branch. The bank isn’t allowing withdrawals. We can’t trust any bank anymore—our entire savings are stuck’

Ashok Bhosale, A retired fire brigade officer

‘I kept Rs 15 lakh here for my daughter’s wedding. The bank says R5 lakh will be released, but when? What about the rest? This is a financial disaster’

Deepak Patel, Driver

‘I saved for my sister’s wedding in May. My family depends on me, and now my money is stuck. I am helpless. The RBI must intervene’

Sardar Gurjyot Singh Keer (Guru), NCP-SP spokesperson

‘The RBI issued the notice at 9 am, and it circulated online, yet the Mumbai police have done nothing. We have petitioned the Supreme Court to form a Special Investigation Team (SIT) to probe this scam’

Keyur Goghri, Borivli resident

‘My entire family has savings in this bank, over R5 lakh. Suddenly, this morning, we were told the bank is shutting down transactions’

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!