The RBI has placed strict restrictions on New India Co-operative Bank, limiting withdrawals and other banking operations. Here’s what depositors need to know about accessing their funds, claim procedures, and the bank’s future.

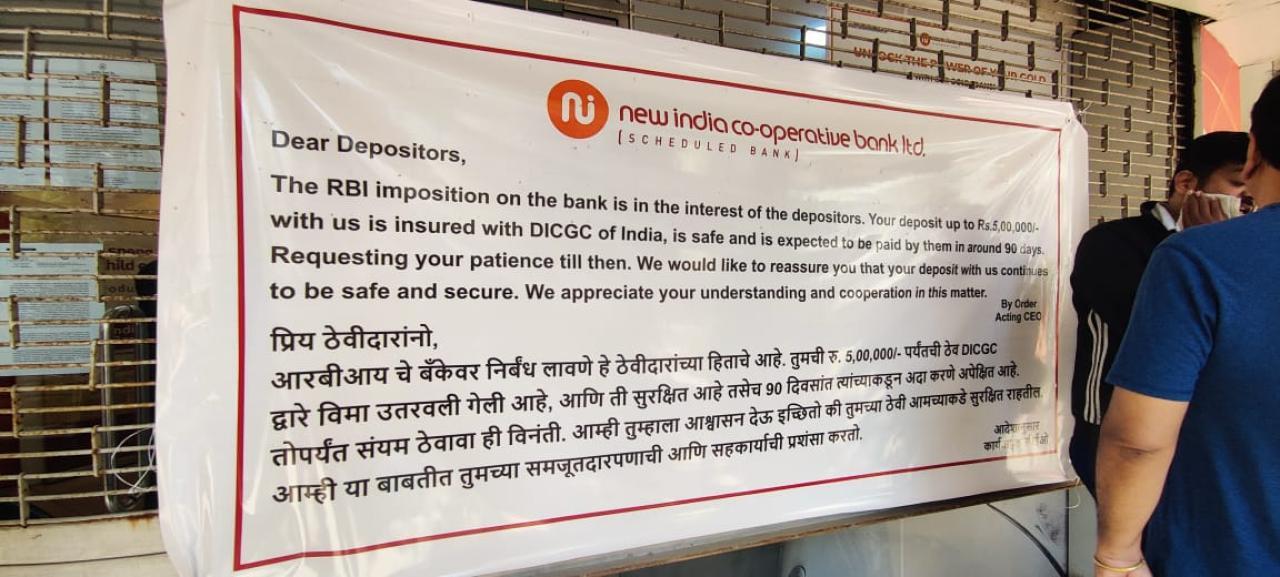

(PIC/NIMESH DAVE)

The Reserve Bank of India (RBI) has imposed strict restrictions on New India Co-operative Bank in Mumbai, citing supervisory concerns over its financial position.

As per the restrictions which are effective from the close of business on 13 February 2025, the bank is barred from carrying out key financial activities without prior approval.

This has raised several concerns among depositors and stakeholders. Here’s everything you need to know about the situation.

1. When will you get my money back?

The RBI has not provided a specific timeline for when depositors can withdraw their funds in full. However, depositors are entitled to claim up to Rs 5,00,000 under the Deposit Insurance and Credit Guarantee Corporation (DICGC) scheme.

2. Can you withdraw your savings currently?

No, depositors are not allowed to withdraw any amount from their savings or current accounts under the current restrictions. However, they may be able to set off loans against their deposits, subject to certain conditions specified by the RBI.

3. When can you remove your deposits? Will you get my money back?

The restrictions will remain in place for six months, after which the RBI will reassess the bank’s financial condition. If the bank’s situation improves, the restrictions may be eased. Meanwhile, insured deposits up to Rs 5,00,000 can be claimed.

4. How can you withdraw your savings? How can depositors claim their insured amount?

Depositors must submit their willingness to claim insurance to the bank. After due verification, the claim amount of up to Rs 5,00,000 will be processed under the provisions of the DICGC Act, 1961. Further details can be obtained from the DICGC website.

5. What happens to my locker?

The RBI's directive does not mention any restrictions on bank lockers. However, some depositors at the Santacruz (East) branch told mid-day.com that the bank manager informed them that customers currently have access to the lockers.

6. What happens to fixed deposits (FDs) in the bank?

Fixed deposits will remain with the bank but cannot be withdrawn until the restrictions are lifted. However, depositors with FDs up to ₹5,00,000 are eligible to claim insurance under DICGC.

7. Will the bank shut down permanently?

No, the bank’s licence has not been revoked. It will continue to operate under restrictions, and the RBI will review its financial condition in six months.

8. What should depositors do next?

Depositors should stay updated on RBI announcements and regularly check the DICGC website for claim-related details. It may also be wise to explore alternative banking options for future financial security.

9. Where can you get more information?

For official updates, depositors can visit the bank’s website or refer to the DICGC website (www.dicgc.org.in) for details on deposit insurance claims. The RBI’s official website may also provide updates on further developments.

10. What restrictions has the RBI placed on New India Co-operative Bank?

The bank cannot grant or renew loans, make investments, borrow funds, accept fresh deposits, disburse payments, or sell assets without RBI approval. The bank can only incur essential expenses such as employee salaries and utility bills.

11. Why has the RBI imposed these restrictions?

The RBI has cited supervisory concerns arising from financial difficulties faced by the bank. These measures have been taken to protect depositors' interests and ensure the stability of the banking system.

12. How long will these restrictions last?

The RBI’s directive will remain in effect for six months from 13 February 2025, subject to review based on the bank’s financial health.

13. Is there any precedent for such restrictions?

Yes, the RBI has previously imposed similar restrictions on banks facing financial distress, such as Punjab and Maharashtra Co-operative Bank in 2019. In that case, the RBI later facilitated its takeover by another financial institution.

14. Will salaries of bank employees be affected?

No, the RBI has permitted the bank to incur essential expenses, including salaries, rent, and utility bills.

While the RBI’s intervention aims to protect depositors, the coming months will be crucial in determining the future of New India Co-operative Bank. Customers should stay informed and explore alternative banking options where necessary.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!