As fin-min outlines strategic reform formula like a fine T20 chase, there are googlies galore for the middle-class and investors

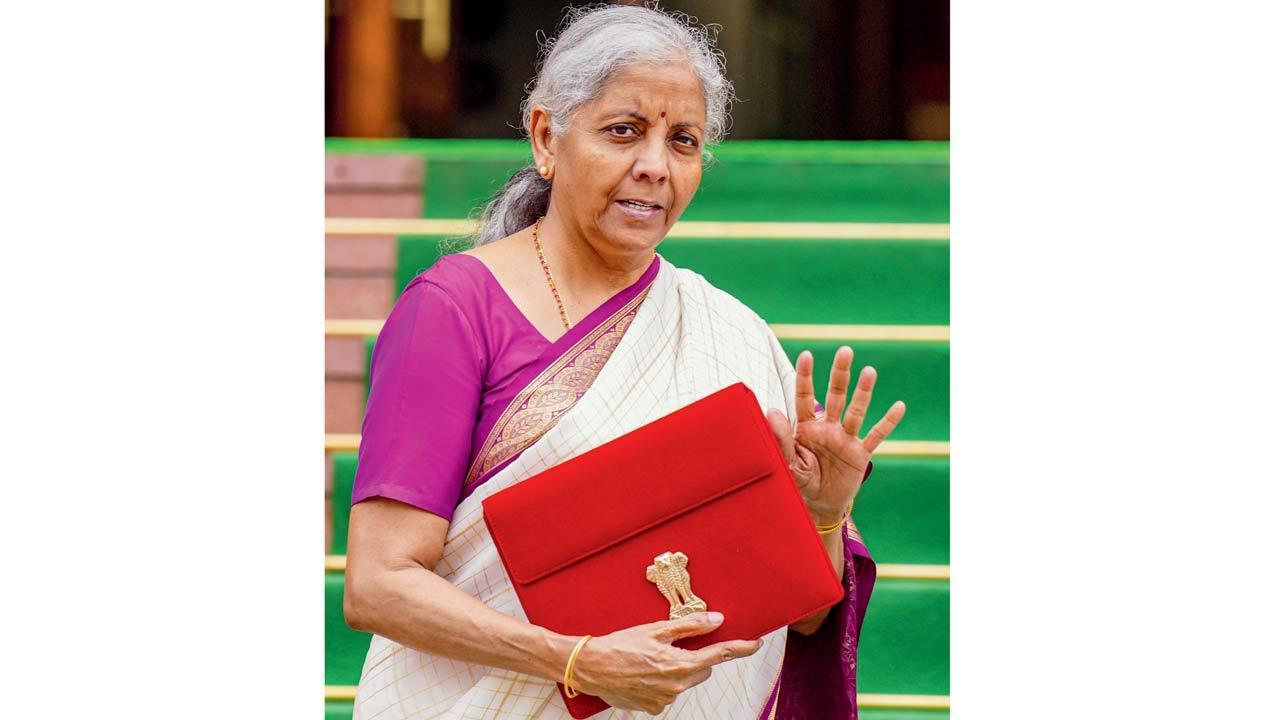

Union Finance Minister Nirmala Sitharaman

As the world eagerly awaits the Paris Olympics beginning on July 26, India is engaged in its own version of a global spectacle: a vision for 2047, which includes a dynamic overhaul of its tax landscape. The run-up resembles strategy in a World Cup cricket match. Just as players strategise power plays to secure victories, our finance ministers have implemented bold reforms aimed at reshaping India’s economic landscape. These reforms focus on promoting investment and domestic production, simplifying and rationalising tax processes, improving tax administration and litigation and ensuring tax fairness.

As the world eagerly awaits the Paris Olympics beginning on July 26, India is engaged in its own version of a global spectacle: a vision for 2047, which includes a dynamic overhaul of its tax landscape. The run-up resembles strategy in a World Cup cricket match. Just as players strategise power plays to secure victories, our finance ministers have implemented bold reforms aimed at reshaping India’s economic landscape. These reforms focus on promoting investment and domestic production, simplifying and rationalising tax processes, improving tax administration and litigation and ensuring tax fairness.

Much like calculated innings in cricket, the new tax regime is designed to benefit the salaried class and middle-income groups. The strategy includes changes to the tax slabs, an increase in the standard deduction from Rs 50,000 to Rs 75,000 aimed at lowering taxes, higher thresholds for tax liability leading to a tax saving of Rs 17,500 annually per employee, easier claiming of credit for TCS collected and TDS deducted, and optimised financial planning for millions of employees.

Bumrah v Jansen

Similar to a booming inswinger, the finance ministry has introduced amendments impacting long-term and short-term capital gains taxes. There are now only two holding periods: 12 months for listed financial assets and 24 months for all other assets. Long-term gains from listed equities once grandfathered in 2018, now face a revised tax rate of 12.5 per cent compared to the previous rate of 10 per cent, while short-term gains are subject to an increased tax rate of 20 per cent, up from 15 per cent. The exemption limit for capital gains on certain listed financial assets has increased from R1 lakh to R1.25 lakh per year. Additionally, the increase in STT rates to 0.1 per cent and 0.02 per cent for F&O has come as an unexpected yorker to daily traders.

Caught napping

Just as the unexpected De Kock-Axar run-out disrupted the innings in the World Cup final, the removal of indexation benefits on the sale of property and other assets has surprised many taxpayers. This change, along with the revised rate on long-term capital gains, effective immediately, alters financial planning strategies for property sales. However, taxpayers will continue to benefit from the exemption for capital gains in cases of reinvestment as provided under the old regulations, and property values indexed up to 2001 are grandfathered for capital gains.

Union Finance Minister Nirmala Sitharaman displays a red folder containing the Budget documents after she arrived at Parliament to present the budget with her team. Pics/PTI

Classic Kohli

Recognising the challenges faced by startups, the removal of angel tax, the provision taxing excess consideration for shares over their fair market value, the increase in tax incentives for units in IFSC, and the establishment of safe harbour rates for specific industries aim to stimulate entrepreneurial and global growth.

Rationalised TDS rates (from five per cent to two per cent for insurance commissions, lottery ticket sales commissions, brokerage payments, and certain rents, and from one per cent to 0.1 per cent for e-commerce operators) are designed to support economic growth and create a stable fiscal environment.

Similarly, reduced corporate tax rates for foreign companies, from 40 per cent to 35 per cent, and the removal of a 2 per cent equalisation levy on non-resident e-commerce operators' consideration aim to encourage investment, in line with global practices.

Suryakumar Yadav’s focus on the World Cup catch amidst pressure mirrors the goal of streamlining and reducing litigation, achieving timely outcomes for parties involved in tax disputes, and encouraging the ease of doing business. This can be achieved through the introduction of the Vivad se Vishwas scheme, which reduces the multiplicity of proceedings; the block assessment scheme for early finalisation of search assessments; coordinated investigations; and the reduction of scope and time limits for issuing notices and reopening assessments.

Slower ones

Much like a well-placed slower delivery, the amendments to customs duty—including the reduction of duty and exemptions—have targeted key sectors such as medicine, critical minerals, and solar energy. These changes intend to bolster domestic production and reduce dependency on imports.

To adapt

Like Axar’s approach to batting and adapting his game according to match situations, implementing a presumptive taxation scheme (i.e., deeming 20 per cent of net passenger carriage receipts as taxable profits) to promote domestic cruise ship operations by non-residents, such as bringing Disney cruise ships to India, aims to make India an attractive cruise shipping destination.

Trust tax

Significant changes are underway regarding corporate gifting practices. Previously, companies could transfer assets into private trusts without facing tax implications. However, under the revised regulations, only transfers made by individuals or Hindu Undivided Families to trusts will qualify for exemptions. This shift means that corporations will no longer be able to enjoy the same tax benefits when transferring assets to trusts.

Considering the expectations prior to the budget, the government has missed the opportunity to introduce tax reforms aimed at streamlining compliance for NRIs or boosting investment by NRIs in Indian markets.

The issue of adding Bihar and Andhra while ignoring states such as Maharashtra that contribute significant fiscal revenues, gives the impression that, much like Biden seemingly focusing on Kamala Harris, there is a perceived favouritism in policy attention.

Hitman’s approach

As India prepares for the economic equivalent of a sporting showdown, these reforms signify a proactive step towards enhancing fiscal efficiency and encouraging growth across various sectors. Much like athletes striving for Olympic gold, policymakers are aiming for economic resilience and prosperity as the nation gears up for the challenges ahead.

Dr Mitil Chokshi, CA is senior partner, Chokshi and Chokshi

Highlights of Union Budget 2024-25

>> Standard deduction in new tax regime hiked to Rs 75,000 from Rs 50,000

>> Deduction on family pension for pensioners raised from Rs 15,000 to Rs 25,000

>> Customs duty on mobile phone, mobile Printed Circuit Board Assembly (PCBA) and mobile charger reduced to 15%

>> Customs duties on gold and silver reduced to 6% and that on platinum to 6.4%.

>> Security Transactions Tax on futures and options of securities increased to 0.02 per cent and 0.1 per cent, respectively.

>> Income received on buy back of shares to be taxed in the hands of recipient

>> Angel tax for all classes of investors abolished to boost start-ups

>> 20% tax on short-term gains on certain financial assets. 12.5% tax on long term gains on all financial and non-financial assets

>> Delay for payment of TDS up to due date of filing statement decriminalised

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!