In a major relief for the middle-class, Finance Minister Arun Jaitley announced that those earning between Rs 2.5-5 lakh will only have to pay 5 per cent tax. Other highlights of Union Budget 2017

Union Minister for Finance Arun Jaitley giving final touches to the Union Budget 2017-18, at North Block in New Delhi on Tuesday. Pic/ PTI

ADVERTISEMENT

In a major relief for the middle-class, Finance Minister Arun Jaitley announced that those earning between Rs 2.5-5 lakh will only have to pay 5 per cent tax. Here are the highlights of Union Budget 2017.

Income tax rate cut to 5 pc for individuals having income between Rs 2.5 lakh to Rs 5 lakh

Of 3.7 cr individuals who filed tax returns in 2015-16, 99 lakh showed income below exemption limit

10 pc surcharge on individual income above Rs 50 lakh and upto Rs 1 cr to make up for Rs 15,000 cr loss of due to cut in personal I-T rate

15 pc surcharge on income above Rs 1 cr to continue

Cash transactions above Rs 3 lakh to banned

Demonetisation a bold measure against decades of tax evasion

Demonetisation will help in transfer of resources from tax evaders to government

Effects of demonetisation not expected to spill over to the next year, says Finance Minister

Maximum amount of cash donation a political party can receive will be Rs 2000 from any one source as part of effort to clean political funding

Political parties can receive donations in cheque, electronic mode; electoral bonds to be issued by RBI

FPI to be exempt from indirect transfer provisions

Customs duty on LNG halved to 2.5 pc

Narendra Modi

With abolition of plan and non-plan expenditure, the govt's focus is on revenue and capital expenditure

Govt pegs fiscal deficit target at 3.2 per cent for 2017-18 and 3 per cent for next year

Revenue deficit reduced to 2.1 pc from 2.3 pc for 2016-17

Of 76 lakh individuals who reported income of over Rs 5 lakh, 56 lakh are salaried

We are largely a tax non-compliant society

After demonetisation on Nov 8 last year, deposit of between Rs 2 lakh and Rs 80 lakh made in 1.09 cr bank accounts at an average of Rs 5.03 lakh till Dec 3

3 yr period for long-term capital gains tax on immovalble property reduced to 2 years; base year indexation shifted from 1.4.1981 to 1.4.2001

Rs 7,200 cr revenue loss due to reduction in tax on smaller companies

Head post offices to issue passports

Govt to set up a web-based interactive platform for defence pensioner

Govt mulling introduction of legal changes to confiscate assets of offenders, including economic offenders, who flee the country

Total expenditure in FY18 at Rs 21.47 lakh cr

Over Rs 80 lakh deposits in 1.48 lakh cr at an average of Rs 3.31 cr per account

Govt to double lending target under PM Mudra Yojana to Rs 2,44,000 crore for 2017-18

Govt doubles distribution target under Mudra Yojana to Rs 2.44 lakh crore for 2017-18

Govt to introduce two new schemes to promote BHIM App - referal bonus for users and cash back for traders

A proposal to receive all government receipts beyond a certain threshold through e-modes under consideration

Payment regulatory board to be set up in RBI to regulate electronic payments, replacing Board for Regulation and Supervision in Payments and Settlements System

FRBM review committee has recommended 60 pc debt to GDP ratio; 0.5 pc of GDP deviation from stipulated fiscal deficit targets

Govt considering option to amend Negotiable Instruments Act to ensure that holders of dishonoured cheques get payment

Govt took two tectonic policy initiatives - passage of GST Bill and demonetisation

Tax administration honouring the honest is one of the 10 pillars of Budget 2017-18

Target of agriculture credit fixed at Rs 10 lakh cr in 2017-18

Rs 9,000 cr higher allocation for payment of sugarcane arrears

Select airports in tier-II cities to be taken up for operations, development on PPP mode

Budget allocation for highways stepped up to Rs 64,000 crore in FY18 from Rs 57,676 crore

Allocation of Rs 10,000 cr for Bharat Net project for providing high-speed broadband in FY18

For transport sector, including railways, road and shipping, government provides Rs 2.41 lakh crore

Coverage of Fasal Bima Yojana to go up from 30 pc of cropped area to 40 pc in 2017-18 and 50 per cent next year

Crude oil strategic reserves to be set up in Odisha and Rajasthan apart from 3 already constructed

Digi Gaon will be launched to promote tele-medicine and education

Dedicated micro-irrigation fund to be set up by NABARD to achieve mission of Per Drop, More Crop

--------------------------------------------------------------------------------------------------------

Railways

Capital and development expenditure pegged at Rs 1.31 lakh cr for railways in 2017-18 from Budget

Rs 1 lakh cr corpus for railway safety fund over five years

Total allocation for rural, agri and allied sectors for 2017-18 is a record Rs 1,87,223 cr, up 24 per cent from last year

Railway line of 3,500 km will be commissioned in 2017-18 as against 2,800 km in 2016-17

Unmanned railway level crossings to be eliminated by 2020

500 stations will be differently abled by providing lifts and escalators

Government proposes Coach Mitra facility to redress grievances related to rail coaches

Delhi and Jaipur to have solid waste management plants and five more to be set up later

Service charge on e-tickets booked through IRCTC will be withdrawn

Railway tariffs to be fixed on the basis of cost, social obligation and competition

New metro rail policy to be unveiled

--------------------------------------------------------------------------------------------------------

Govt to further liberalise FDI policy

Computer emergency response team to be set for cyber security of financial sector

Urgent need to protect poor from chit fund schemes, draft bill placed in public domain

Govt will amend the Multi-state Cooperative Act to protect the poor and gullible investors

Rs 2,74,114 crore allocated for defence expenditure, excluding pension; This includes Rs 86,000 crore for defence capital

Dispute resolution in infrastructure projects in PPP mode will be institutionalised

Model Shops and Establishment Bill to open up additional opportunities for employment of women

For senior citizens, Aadhaar based health cards will be issued

35 pc increase in allocation for SC to Rs 52,393 cr

Allocation for SCs increased from Rs 38,833 cr to Rs 52,393 cr, a rise of 35 per cent

A scheme for senior citizens to ensure 8 per cent guaranteed return

Allocation under MNREGA increased to 48,000 crore from Rs 38,500 crore. This is highest ever allocation, says FM

Space technology to be used for monitoring MNREGA implementation

A system of annual learning outcome in schools to be introduced; innovation fund for secondary education to be set

up

In higher education, we will undertake reforms in UGC, give autonomy to colleges and institutions

The allocation for rural agri and allied sector in 2017-18 is record Rs 1,81,223 crore

PM Kaushal Kendras will be extended to 600 districts; 100 international skill centres to be opened to help people get jobs abroad

Rs 500 cr allocated to set up Mahila Shakti Kendras; Allocation raised from Rs 1.56 lakh cr to Rs 1.84 lakh cr for women & child welfare

National Housing Bank will refinance indiviual loans worth Rs 20,000 crore in 2017-18

1.5 lakh health sub centres to be converted to Health Wellness Centres

New rules regarding medical devices will be devised to reduce their cost

Two new AIIMS to be set up Jharkhand and Gujarat

Market reforms will be undertaken, states will be asked to denotify perishables from Essential Commodities Act

Dedicated micro-irrigation fund to be created with a corpus of Rs 5000 crore

Modern law on contract farming will be drafted and circulated to states

Participation of women in MNREGA increased to 55 pc from 45 pc in past

1 cr households to be brought out of poverty under Antodya Scheme, by 2019

Govt to set up dairy processing fund of Rs 8,000 crore over three years with initial corpus of Rs 2,000 crore

133-km road per day constructred under Pradhan Mantri Gram Sadak Yojana as against 73-km in 2011-14

National Testing agency to conduct all examinations in higher education, freeing CBSE and other agencies

27,000 cr on to be spend on PMGSY; 1 cr houses to be completed by 2017-18 for houseless

100 pc electrification of villages to be completed by May 2018

To construct one crore houses by 2019 for homeless. PM Awas Yojana allocation raised from Rs 15,000 cr to Rs 23,000 cr

We propose to provide safe drinking water to 28,000 arsenic and fluoride affected habitations

Sanitation coverage in villages has increased from 42 pc in Oct 2016 to 60 pc, a rise of 18 pc

GDP will be bigger, cleaner after demonetisation

Second phase of solar power development to be taken up with an aim of generating 20,000 MW

Trade Infrastructure Export Scheme to be launched in 2017-18; total allocation for infra at record Rs 3.96 lakh cr

FIPB will be abolished

Over 90 per cent of FDI proposls are now processed through automatic route

Functional autonomy of the railways to be maintained

Agricultural sector is expected to grow at 4.1 per cent this fiscal

More steps will be taken to benefit farmers and the weaker sections; budget being presented during weak global economy

We are seen as engine of global growth; IMF sees India to grow fastest in major economies

Only transient impact on economy due to demonetisation; long term benefit include higher GDP growth and tax revenue

Uncertainty around commodity prices especially oil to have impact on emerging economies

CAD declined from 1 pc last year to 0.3 pc in first half of current fiscal

36 pc increase in FDI flow; forex reserves at USD 361 billion in January enough to cover 12 months needs

Double digit inflation has been controlled; sluggish growth replaced by high growth; war on blackmoney launched

We have moved from discretionary based administration to policy based administration

Positive signs for the coming year

Proof of higher agricultural growth

Early evidence of banks lending at reduced rates

Focus on infrastructure, alleviation of poverty

Merging rail budget with general budget is historic

Transform, energise, clean India is next year's agenda

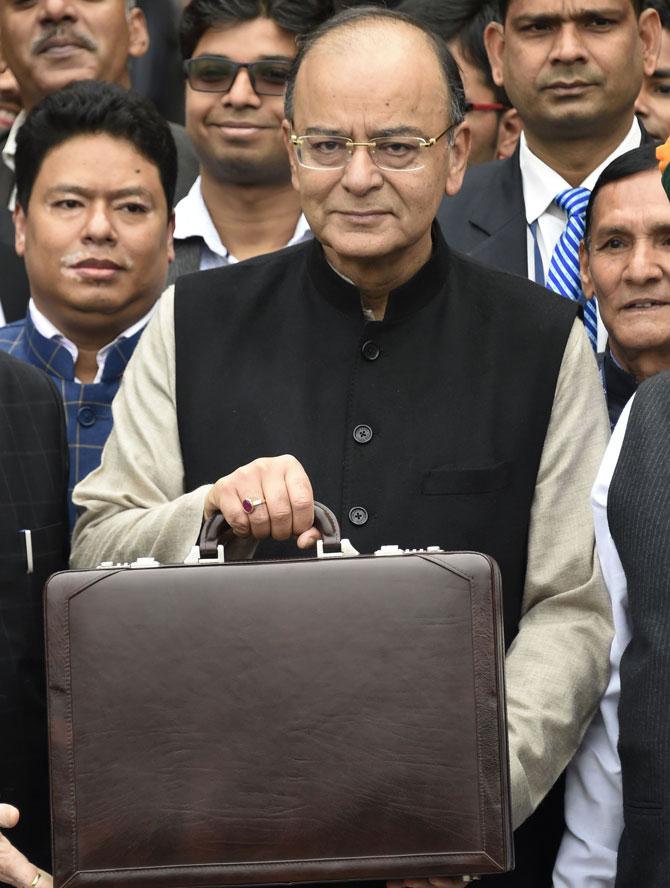

Finance Minister Arun Jaitley (C) leaves his office to table the budget in Parliament in New Delhi

It's the first time that the Budget is being tabled on February 1 instead of the usual February 28. Also, for the first time, there will be no separate Rail Budget.

Pre-Budget Updates

11:00 am: Speaker rejects Congress’ demand to postpone budget

10:55 am: Budget has sanctity; we are already in the eleventh hour. There should be no controversy over it. It's a constitutional obligation, says Venkaiah Naidu.

10:50 am: Saddened by E Ahamed's demise, but Budget will be presented. We have to keep in mind that Budget is a constitutional obligation, says Sumitra Mahajan.

10:39 am: Budget 2017 will be presented today, says Lok Sabha Speaker Sumitra Mahajan.

10:21 am: In our opinion, including JDU leaders and former Prime Minister Deve Gowda, the Budget should be postponed, says Congress leader Mallikarjun Khadge.

10:04 am: Cabinet to meet in Parliament ahead of Budget 2017.

9.50 am: Finance Minister Arun Jaitley reaches the Parliament to present Budget 2017.

9.48 am: There is a precedent, in the past too a sitting MP/MoS passed away and the Budget was presented, say government sources.

9.45 am: Budget 2017 will be presented, obituary may happen before or after it, government has spoken to all parties and arrived at consensus, say sources.

9:14 am: Budget 2017 copies reach Parliament.

Finance Minister Arun Jaitley (C) leaves his office to table the budget in Parliament in New Delhi

9:11 am: Normally Parliament is adjourned on death of sitting MP, so chances are Budget can be postponed for a day. Speaker will decide, says Santosh Gangwar.

9:08 am: Finance Minister Arun Jaitley leaves for Rashtrapati Bhavan to meet President Pranab Mukherjee ahead of Budget 2017.

8:54 am: Arun Jaitley reaches Finance Ministry ahead of Budget 2017.

8:31 am: Due to the death of former union minister E Ahamed, Budget 2017 may be postponed by a day, say media reports.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!