Experts insist RBI’s decision will not cause as much inconvenience as demonetisation did in 2016 and won’t have any “perceptible effect” on the economy

Representation pic

Even though the Reserve Bank of India (RBI) has made it clear that Rs 2,000 notes will still be accepted as legal tender and that existing Rs 2,000 notes can still be deposited or exchanged in banks till September 30, the restriction of Rs 20,000 at a time has left citizens comparing the situation with the demonetisation of 2016.

ADVERTISEMENT

On Friday, the RBI, in a circular, announced the withdrawal of its highest denomination currency note and advised the people to deposit Rs 2,000 notes in their accounts or exchange them in banks, while also instructing banks to stop issuing the notes immediately. The long queues outside banks and the scramble to deposit demonetised currency in 2016 continue to haunt citizens even today and hence, the RBI’s decision has elicited varying reactions from citizens.

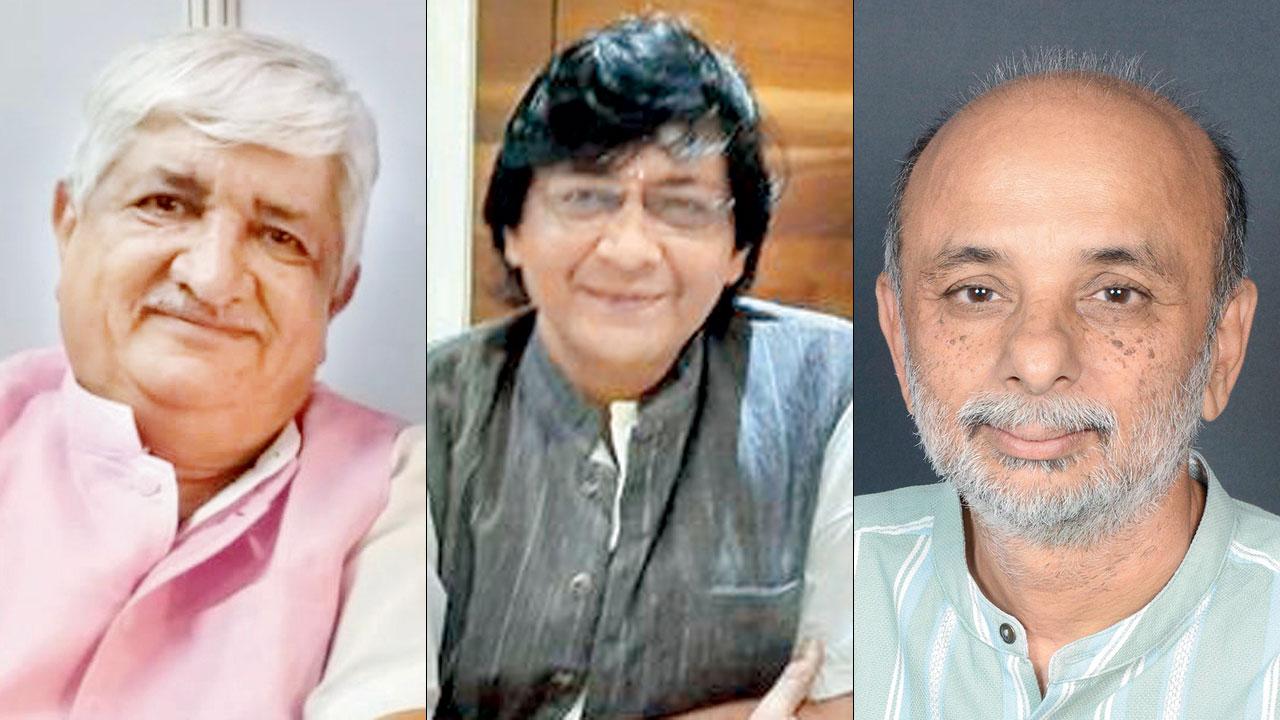

Devji Bhadra, Gopal Jhaveri and Neeraj Hatekar

“I don’t see any problem with the RBI’s decision. However, if I have to deposit a large number of Rs 2,000 notes, the limit of Rs 20,000 at a time means that I will have to make several trips to the bank. If banks have data like my PAN card and Aadhar card, they also know that I am a senior citizen and can’t be expected to make multiple trips. I hope this doesn’t end up inconveniencing citizens the way it did during demonetisation. I am sure there might be some way out. It’s just that there’s less clarity right now, and people are confused due to the September 30 deadline,” said Devji Bhadra (72), a resident of Ghatkopar. Borivli resident Gopal Jhaveri, however, did not foresee any problems this time round.

“I feel this is not going to be a problem, simply because the lower middle class and even the middle class doesn’t have that many Rs 2,000 notes to begin with. Also, the usage of online transactions via cards and apps has increased, and hence, the trend of possessing physical currency has decreased. If the government is claiming that over three lakh such notes are in circulation, where are they? The Rs 20,000 limit might be for convenience of the banks, and we should cooperate with the government on this,” said Jhaveri. Economists, however, said that the decision will not inconvenience citizens and that they shouldn’t compare it with demonetization.

Renowned economist Professor Neeraj Hatekar, currently with the School of Development at the Azim Premji University in Bengaluru told mid-day, “The Rs 2,000 notes are not popular for transactions. Almost 89 per cent of these notes are from 2017, and they are old notes now. The government felt they should not be in circulation. You have the option to convert it as in exchange for notes of lower denomination or deposit it. This deadline given is for existing stock, which might not be in higher numbers. We must understand that the note is not being canceled, and hence it should not inconvenience anyone.”

An economist and former MU faculty member added that the RBI’s decision will not have any “perceptible effect” on the economy, as any notes returned will either be replaced by equivalent cash in lower denomination notes or deposited in accounts.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!