Country’s richest civic body turns to experts as coffers shrink

The Brihanmumbai Municipal Corporation headquarters at Fort in south Mumbai. Representation pic/Ashish Raje

The BMC wants to learn how cities worldwide are generating revenue to fund their administration and urban services. The civic body has appointed a consultant to research global revenue models and suggest similar sources before next year’s budget presentation to help boost its dwindling revenue.

ADVERTISEMENT

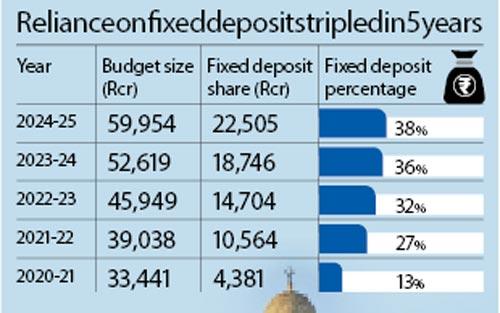

Though still considered the wealthiest municipal corporation in the country, the Brihanmumbai Municipal Corporation (BMC) is struggling to bridge the gap between revenue and expenditure. For the current financial year, the civic body sanctioned a budget of Rs 60,000 crore but has to withdraw Rs 22,500 crore from fixed deposits to cover project costs. The fixed deposits have depleted by Rs 10,000 crore in just two years, and projects worth Rs 2,00,000 crore have already been sanctioned. As a result, the BMC has appointed a consultant to explore more revenue sources to support its growing expenditure.

“The BMC selected M/s Ernst and Young LLP to suggest new revenue sources and recommend upgrades for the accounts department’s functioning. No other corporation in the country matches the BMC in scale, so they will study revenue models from global cities and suggest implementable sources here,” said a BMC official. He added that while the contract lasts nine months, they expect some ideas to be presented by February, so they can be incorporated into next year’s budget.

The BMC is paying Rs 71 lakh for the consultation. This is not the first time the BMC has sought to increase its revenue sources. The corporation heavily depends on compensation from the state government in lieu of octroi, as property tax, its second-largest source, has declined in contribution.

In the 2023-24 budget, the BMC proposed new revenue streams, such as appointing agencies to boost property tax collection and advertising on BMC properties. They also suggested increasing property tax rates and hiring an agency to recover pending dues. However, none of these proposals materialised.

About ten years ago, there was a proposal to levy a Rs 100 property tax on every slum dwelling, but political parties opposed it. A few years later, they also waived property tax for apartments measuring up to 500 square feet. The BMC has not implemented a pending 16 per cent hike in property tax for the past five years, nor has it enforced the yearly 8 per cent increase in water bills.

“There are many challenges in increasing revenue. The BMC needs a long-term, practical solution and must focus on incremental changes rather than imposing a heavy tax burden on citizens,” said another BMC official.

For the current year (2024-25), the BMC has a budget of Rs 59,954 crore. The revenue income is estimated at Rs 36,644 crore, and the gap will be covered by withdrawing Rs 22,505 crore from fixed deposits. The BMC has kept ambiguity over the proposed property tax hike and other potential revenue sources.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!