Many co-operative credit society banks say there is a lack of instructions and clarity from the RBI on exchange

Sangli Vaibhav Cooperative Credit Society Ltd; (right) Dnyandeep Co-operative Credit Society Bank. Pics/Rajesh Gupta

Confusion prevails among 25,000 co-operative credit society banks in Maharashtra regarding the acceptance of Rs 2,000 notes. Many of these banks have been refusing to accept the currency, while some have even issued circulars flatly denying the acceptance of Rs 2,000 notes.

Dnyandeep Co-operative Credit Society Limited, based in Kandivali, has even issued a circular instructing its customers not to accept Rs 2,000 notes and advising them to deposit the currency in national banks only. When mid-day reporters visited various co-operative credit societies and small finance banks, they found that many of them were not exchanging or depositing the currency due to a lack of information.

IN PHOTOS: Head to Girgaon Chowpatty for a slurpy bite of Ice Golas

When mid-day asked Dnyandeep Co-operative Credit Society Limited in Kandivli West about their refusal to exchange Rs 2,000 notes, they stated that they had received instructions from their superiors not to accept these notes. Laxman Chavan, Chairman of Dnyandeep Society, said, “We issued a circular on May 20 based on instructions from our society’s directors. In the circular, we also requested our members to deposit or exchange the Rs 2,000 notes at their respective banks. We are not accepting Rs 2,000 notes for loan repayment, fixed deposits, or any other transactions.” He also further explained that they are following the instructions of the Board of Directors. Also, there are no clear instructions for credit societies from RBI.

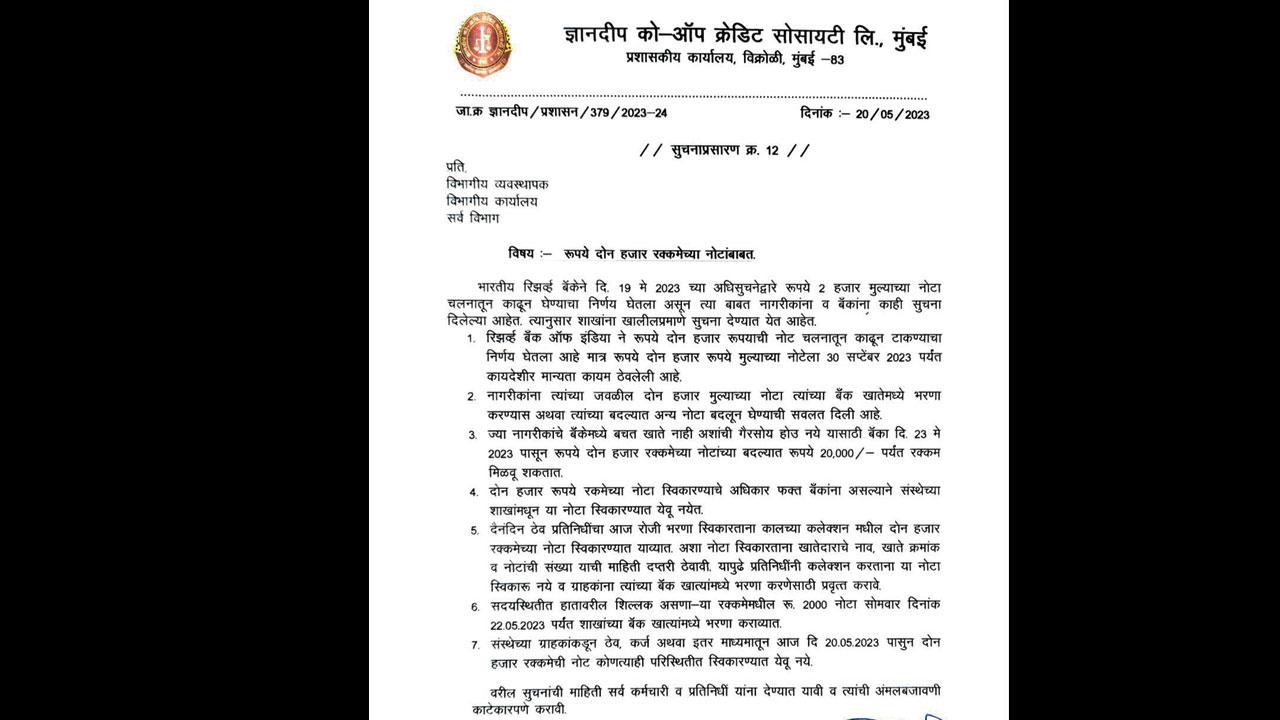

The circular issued by Dnyandeep Co-operative Credit Society Limited in Kandivli informing its members that they won’t accept Rs 2,000 notes

The circular issued by Dnyandeep Co-operative Credit Society Limited in Kandivli informing its members that they won’t accept Rs 2,000 notes

At Sangli Vaibhav Co-op Society in Andheri, they have also stopped accepting Rs 2000 notes. However, if members want to make a fixed deposit, the society will accept the Rs 2000 notes for a minimum duration of 13 months. The lady officer stated that the RBI guidelines instructed to deposit these notes in banks only, not in any credit societies. When mid-day asked the Citizen Credit Co-op Bank at Mahim if they would exchange the Rs 2000 notes, a bank employee informed them that they were not exchanging the notes but members could deposit them into their accounts.

The bank officer explained, “Only those who have an account in our bank are allowed to deposit Rs 2,000 notes into their accounts. There are no limits on deposits into accounts.” ESAF Small Finance Bank, Mumbai District Central Co-operative Bank, The Malad Sahkari Bank Limited, and other national banks are exchanging the Rs 2,000 notes with a limit of Rs 20,000 per day.

Citizen Credit Co-operative bank

Citizen Credit Co-operative bank

Pravin Darekar, a BJP leader and President of Mumbai District Central Co-operative Bank Limited, said, “All co-operative banks and small finance banks across Maharashtra are our members. Recently, the RBI issued a circular for banks. However, there are no instructions for credit societies and small finance banks. There is confusion among credit societies about whether to accept the notes or not. Many credit societies are not accepting these notes due to uncertainty about whether banks will accept them or not.”

RBI Officials Speak

When mid-day asked RBI officials if they had given any instructions to co-op credit societies regarding the acceptance of Rs 2,000 notes, the officials responded by saying, “The RBI issued a circular about Rs 2,000 notes to all banks. We do not issue a circular specifically for credit societies.”

It is evident from the statements and actions of various co-operative credit societies and banks that there is confusion regarding the acceptance of notes. While some banks have outrightly refused to accept these notes, others have restricted their acceptance to certain transactions or only for their existing members. The primary reason cited for not accepting these banknotes is the lack of specific instructions from the RBI for credit societies.

To address this confusion and provide clarity, Pravin Darekar, President of Mumbai District Central Co-operative Bank Limited, has called for the RBI to issue a circular specifically for credit societies, outlining the guidelines for accepting or depositing Rs 2,000 banknotes.

Rs 20k

Daily limit for exchange of Rs 2K notes

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!