The civic body, which has around Rs 86,000 crore in fixed deposits, has turned to its last resort as traditional revenue streams dry up

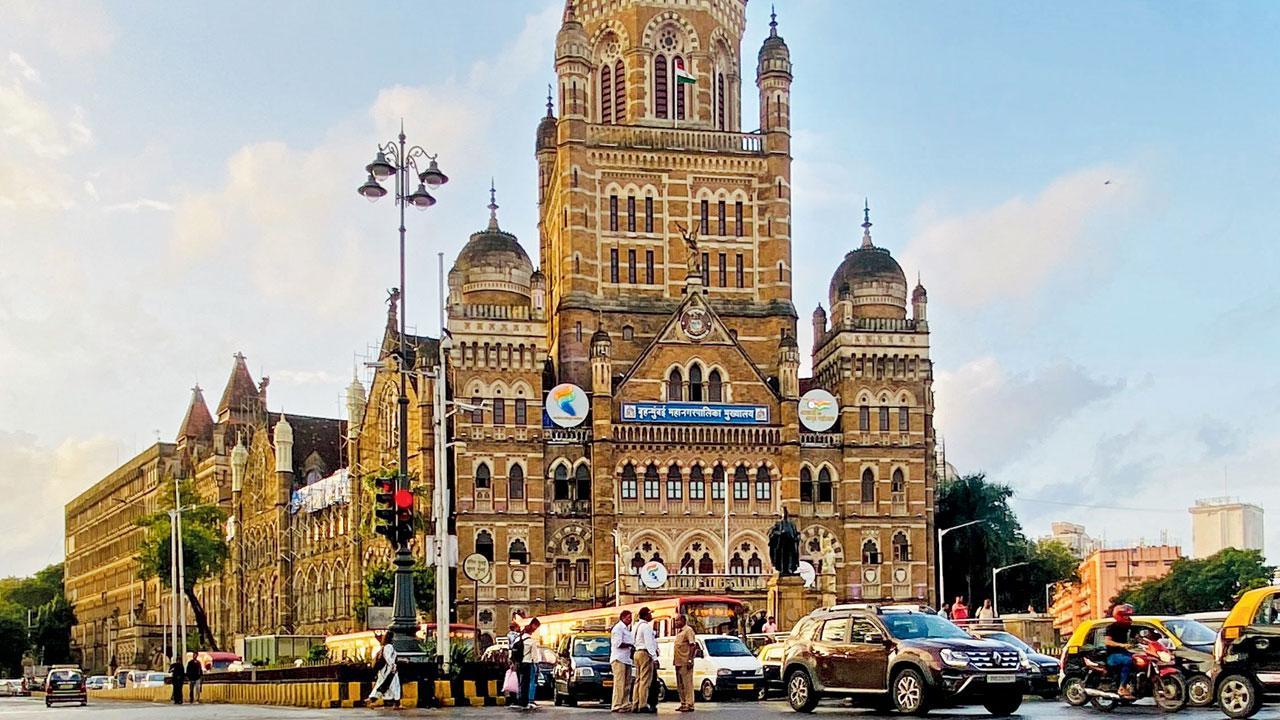

The BMC headquarters in Fort. Pic/Shadab Khan

With only Rs 10,343 crore, or 40 per cent of infrastructure funds, spent till December 2023, the Brihanmumbai Municipal Corporation (BMC) is thinking of spending Rs 31,774 crore in the coming financial year. The BMC Administrator, Iqbal Singh Chahal, proposed a budget of Rs 59,954 crore for the next year, 2024-25. The revenue income of the BMC is estimated at Rs 36,644 crore, and the gap between income and expenses will be filled by fetching another Rs 22,505 crore from fixed deposits.

BMC Chief I S Chahal

The Brihanmumbai Municipal Corporation (BMC) is highly dependent on indirect source of compensation in lieu of octroi from the state as its second-largest source—property tax—has dwindled. The BMC had proposed Rs 28,884 crore for infrastructure work in 2023-24 by fetching Rs 18,617 crore from fixed deposits. But till December, only 40 per cent of it was utilised. Chahal said that in the next two months, the capital expenditure will reach Rs 25,316 crore, and for that, they will be estimated to fetch FDs in and above the revenue income. But if the past few years’ data is anything to go by, capital expenditure won’t reach beyond 65 per cent.

FD share up to 38%

In 2018-19, of the total Rs 33,441-crore budget, the administration proposed the use of Rs 4,380 crore from FDs, which is 13 per cent of the total amount. Now, five years later, the share of FDs has risen to 38 per cent, underlining the dependence on reserve funds.

Property tax dwindles

Till last year, property tax was the second largest source of income for the BMC. But in the revised estimate, the BMC said they will collect around R5,500 crore from Development Plan fees and premiums, and the revised property tax income will be around Rs 4,500 crore only. The BMC estimated Rs 4,950 crore crore from property tax in 2024-25, and Chahal glossed over the question over a hike this year.

Seven revenue generators

The BMC has decided to explore new ways of increasing revenue. In the civic budget of 2024-25, Chahal mentions seven ways to increase the revenue of BMC. The BMC is going to introduce special healthcare fees to patients outside of Mumbai.

Chahal said, “BMC is providing the best healthcare facilities to patients not only from Maharashtra but also other states. It is necessary to think about implementing a ‘Separate Fee Structure’ for people coming for treatment from outside of Maharashtra,” Chahal said. “A review will be done to explore the possibility of imposing a Separate Fee Structure for patients within Maharashtra, from outside of Mumbai.”

To avoid tolls on mega roads, the BMC has decided to generate revenue from advertisements and other ways. “We will carry out a financial study to explore the possibility of self-sustainability in Mumbai. These projects require a huge amount of capital expenditure to get them completed in time and with quality,” said Chahal.

BMC has also decided to demand a 75 per cent share as against 25 per cent in the revenue received on account of premium charges for an additional 0.50 FSI and a 70 per cent share as against 50 per cent in premium on account of Fungible Compensatory FSI. “Correspondence has been made with the State to consider the share in this well-deserved revenue expected on account of FSI premium to BMC,” said the official.

The BMC has decided to develop a transport hub on the Octroi Naka site at Dahisar and Mankurd. Along with the transportation hub, it is proposed to develop the full potential of the plot and compatible development like commercial, office spaces, retail spaces, transit hotel, convention centre, exhibition centre, etc. This would generate revenue and make the project sustainable.

Furthermore, the civic body has decided to appoint a world-renowned real estate consultant who would advise, guide and implement a roadmap for the generation of revenue from BMC leasehold and tenanted properties to the tune of Rs 10,000 crore annually. Similarly, it is proposed to invite ward-wise and zone-wise bids for the development of Municipal Tenanted Properties where a cluster of buildings and plots within the same ward can be redeveloped. In the said redevelopment, the entire rehab/sale can be proposed on single or multiple plots within the cluster and one of the plots of the cluster may get vacated. The financial potential of the vacant plots will be explored by BMC by conceding various options including auctioning of the plots.

Capital expenditure for projects

>> Coastal Road Project (South)/ Packages (North Versova to Dahisar)/ Last Leg (Dahisar to Bhayandar Link Road) - Rs 4,250 - 13 per cent

>> MSDP-Sewerage Treatment Plant (STP) - Rs 4,090 - 13 per cent

>> Water Supply - Rs 3,420 - 11 per cent

>> Roads & Traffic Department - Rs 3,200 - 10 per cent

>> Sewerage Disposal- Rs 1,933.61 - 6 per cent

>> Stormwater drains-Rs 1,930 - 6 per cent

>> Goregaon-Mulund Link Road- Rs 1,870 - 6 per cent

>> Health Budget-Rs 1,716.85 - 5 per cent

>> Bridges Department- Rs 1,610 - 5 per cent

>> Redevelopment of SWM Staff Quarters Ashray Yojana - Rs 1,055 - 3 per cent

>> Development Plan Department-Rs 800 - 3 per cent

>> Repairs to Municipal Properties & Slum Improvement - Rs 531.53 - 2 per cent

>> Solid Waste Management & Transport, SWM Project - Rs 459.98 - 2 per cent

>> Repairs to Primary School Buildings- Rs 330,19 - 1 per cent

>> Other - Rs 4,577.43 - 14 per cent

Total- Rs 31,774.59 (in crore rupees)

Sources of income revenue total: 36,644 (in crore rupees)

>> Grant in aid on account of compensation in lieu of octroi: 13,331

>> Receipts from the development plan department: 5,800

>> Property tax: 4950

>> Water & sewerage charges: 1,923

>> Income from investments: 2,206

>> Supervision charges: 1,681

>> Grant-in-aid from the government: 1,249

>> Receipts from roads & bridges: 509

>> Receipts from license department: 325

>> Receipts from hospitals and medical colleges: 338

>> Other receipts: 4,332

Highlights

>> The BMC spent only 40 per cent of infra expenses (R28,884 cr) till December

>> The BMC proposed R31,775 crore for projects in the next year

>> Property tax fell to third place as income source

>> BMC keeps ambiguity over the hike in property tax

How BMC increase income…

>> Different fees for treatment of patients from outside of the city

>> Extra water charges and extra sewerage charges levied on built-up area

>> Develop revenue from mega projects

>> BMC will demand a 75 per cent share by the FSI premium

>> Revenue generation from leased property

Rs 59,954 cr

BMC proposed budget for 2024-25

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!