New con in town is offering high-end credit cards to high-net-worth individuals who are not tech savvy and wiping out their accounts; just four cases registered so far total R1.25 crore; the police say more victims are likely to come forward

The fraudsters sent a compromised Android phone to the victim to get access to their bank details. Representation pic

Fraudsters have now come up with a new scam to cheat high-net-worth individuals. They are offering prestigious Diners Club cards to selected people and getting them to use Android phones sent by them, thus collecting their bank details. Four such cases involving a total of Rs 1.25 crore have been reported in the city in the past two months. City cyber cops on Wednesday arrested three suspects from Chennai in connection with one such case. The police suspect that the racket has spread across the country. One of the gang members even apologised to a victim after the fraud.

The most recent case took place around four days ago when a businessman from the western suburbs received a call offering him Diners Club card. The caller shared a link with him to claim the card. When the businessman was unable to access the link from his iPhone, the caller said the link could only be accessed through Android phones. The caller then asked for his address and sent him an Android phone via a delivery service on the same day.

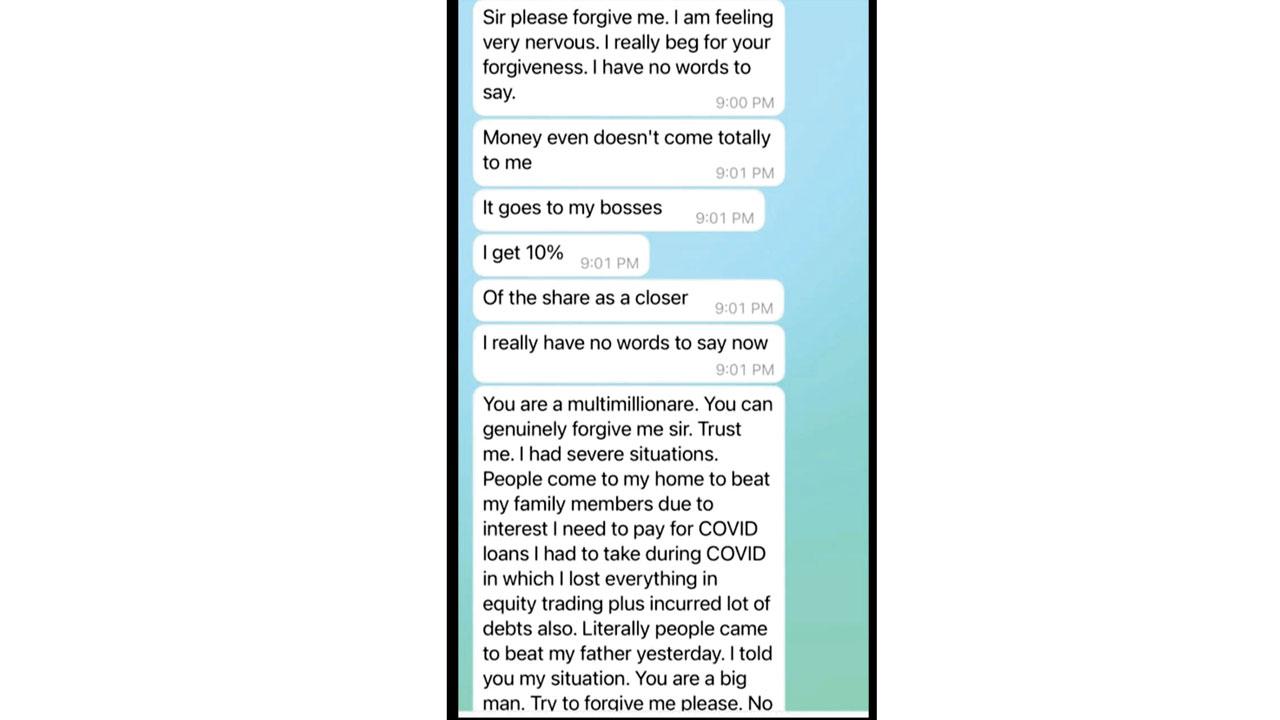

Screenshot of messages sent by a member of the racket to a victim

The businessman, following the directions of the caller, inserted his SIM card into the phone, added his KYC details and other information, including some OTPs, on the link. Within a few minutes, Rs 50 lakh was deducted from his account. Soon after this, the victim received messages from an unknown number which read: “Sir please forgive me. I am feeling very nervous. I really beg for your forgiveness. I have no words to say. Money even doesn't come totally to me. It goes to my bosses. I get 10%. Of the share as a closer. I really have no words to say now [sic].” mid-day got access to a screenshot of the messages from a police source.

Also Read: Mumbai: Bombay HC grants interim relief to 103-yr-old woman, her family

The sender went on to seek his forgiveness and wrote, “You are a multimillionaire. You can genuinely forgive me sir. Trust me. I had severe situations. People come to my home to beat my family members due to interest I need to pay for COVID loans which I had to take during COVID in which I lost everything in equity trading plus incurred a lot of debts also. Literally people came to beat my father yesterday.

I told you my situation. You are a big man. Try to forgive me please [sic].” A police officer said that the message was likely sent by a member of the gang and added, “We are checking the number from which the message was sent.” It was after this message that the businessman reached out to cyber cops to register a complaint. Acting on the complaint, a team was dispatched to Chennai and nabbed three suspects.

Probe findings

A senior police officer said, “We have received four complaints of similar nature in the past two months and the total amount involved in the cases is around Rs 1.25 crore. The fraudsters are specifically targeting high net worth individuals.” The victims in the four cases have lost money ranging from Rs 9 lakh to Rs 50 lakh.

The scamsters used the money siphoned off from victims to purchase jewellery online. Representation pic

Sources said that the cops, during the initial probe, found that the money siphoned off from the victims’ accounts in all four cases were used to place orders for gold jewellery from the online website of a popular brand. The same was picked up from the brand’s physical stores in Chennai and Mumbai using delivery service apps. Cops also suspect that the phones which were sent to the victims were brought from a local store and then delivered via a similar delivery app.

The cyber cops have also learnt that the mobile phones provided by the scamsters were compromised to give them complete access to every activity. Given the profiles of the victims, investigators suspect that the database of some bank was leaked, giving the fraudsters a list of high-net-worth individuals who would be interested in getting Diners Club cards. DCP (Cyber) Balsing Rajput confirmed that a case was filed in this regard but refused to divulge any information, saying there was a “crucial development” in the case.

What is a Diners Club card?

Diners Club International is a banking and payment services company owned by Discover Financial Services. The Diners Club card was the world’s first multipurpose card to be used for dining and travel expenses. It aims to support global dining and entertainment via partnerships, thus benefiting the cardholders, which it calls ‘clubmembers’. Diners Club cards are useful for people who travel frequently around the world and want to take advantage of the benefits of the card at select restaurants, golf clubs, venues and more.

Rs 50L

Amount of money a businessman lost to the fraudsters

4

No. of similar cases filed in the city in 2 months

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!