As Mumbai’s cash flow dries up, BMC scrambles to salvage budget

File photo

Key Highlights

- BMC is marching towards recording the lowest property tax collection

- Delayed bills, disputes over new methods are the reasons behind dwindling revenue

- BMC’s property tax collection has lost its former prominence in recent years

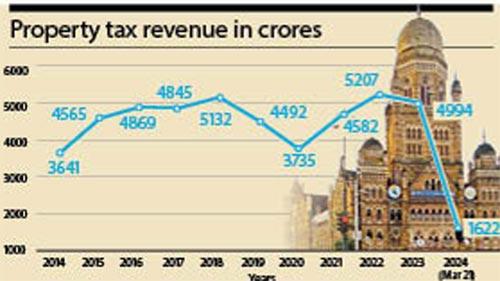

The Brihanmumbai Municipal Corporation (BMC) is marching towards recording the lowest property tax collection in the past 10 years, even lower than the pandemic years. Delayed bills, disputes over new methods of tax calculation and no hike in the last five years are the reasons behind the dwindling revenue source.

Once the major source of funding for the city’s infrastructure projects, BMC’s property tax collection has lost its former prominence in recent years. Until last year, property tax stood as the second-largest income source for BMC after compensation in lieu of octroi from the state government. However, in the revised estimates for 2023-24, BMC expects to collect around Rs 5,500 crore from development plan fees and premiums, with revised property tax income projected to be around Rs 4,500 crore by the end of March. For 2024-25, the BMC estimated Rs 4,950 crore from property tax and Rs 5,800 crore from development plan fees.

It’s evident that the BMC may struggle to meet even the revised target of Rs 4,500 crore (lower than the original target of Rs 6,000 crore) within the next week. As of March 21, the corporation has collected only Rs 1,622 crore, barely 35 per cent of the total. the BMC’s collections may end up being less than those of the pandemic years 2020 and 2021 when it didn’t take stringent action against defaulters.

In a bid to at least meet half of the property tax target, BMC released a list of the top 10 defaulters last week, owing a total of Rs 147 crore in pending taxes. BMC has also introduced a service allowing bill payments on weekends and holidays to address backlog due to delays in sending property bills.

Typically, the BMC sends out property tax bills until July for every financial year. However, last December, the BMC uploaded property tax bills with an unannounced 15 to 20 per cent hike in taxes. Following public backlash, bills were reissued in late February. While property holders have until May 25, 90 days from bill issuance, to pay, the BMC aims to boost revenue before the end of the financial year.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!