Keep a close eye on Pakistan military movements and the Indian response

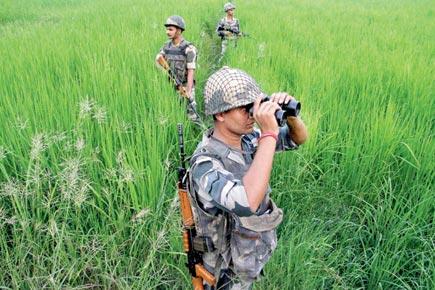

BSF personnel keeping a tight vigil on the Indo-Pak border

ADVERTISEMENT

Nifty closed higher by around .59 per cent on a weekly basis, we saw range bound market movements throughout last week. Tensions between India and Pakistan and concerns of North Korea’s nuclear missile test, were the key reasons for the loss of upward momentum. Investors are cautiously watching Pakistan’s military movements. Weekly and monthly charts of Nifty are still in buy mode, which will give investors opportunities to buy into lower levels. The India VIX and S&P 500 VIX are still lower and will support the markets at lower support levels of Nifty and Dow Jones. Nifty has support at 8779 and 8697, a decisive move below these levels can cause possible bull liquidation. Resistances for Nifty are at 8893 and 9069.

India’s central government and state governments reached an agreement on keeping traders, with an annual revenue of up to 20 lakh. The threshold is accepted by a majority of states. All GST related rates will be decided in the meeting to be held on October 17-19. Rolling out GST will take place in April 2017. It is a major booster dose for the economy, and we can expect sharp uptrend in India’s GDP growth, post that.

Pakistan terror

CLSA, Credit Suisse and Morgan Stanley cut exposure in Indian equities, due to higher valuations. CLSA cuts weightage by 2 per cent points. Some of these funds reduced exposure in the private sector banking space due to higher valuations. Banking Nifty is slightly weak. It closed at 19901 levels. Banking Nifty has support at 19750 and 19584. Resistances for the Banking Nifty are 20240 and 20559.

With the Pak terrorist attack at the Indian army base at Uri, more provocative moves are expected from militants. The Indian army is ready to counterattack. Pakistan’s stock exchange, Index Karachi 100, should be watched closely. Aggressive movements of Pakistani troops can be reflected on the Index. Karachi 100 Index on Friday, closed at 39781 and it has support at 39305 and 39164. Further downward movements in the Index can cause bull liquidation. Karachi 100 index has resistance at 40293. Its weekly and daily charts are given a sell signal, and can pull down the index in the near term.

Giving direction

OPEC and non OPEC members have agreed to meet, end September. The members expect Saudi’s offer to reduce production if Iran agrees to cut its own output this year, which will lift the commodity prices. The latest US inventory data fell by 6.2 million barrels. Traders and investors expected an inventory increase of 3.35 million barrels. Crude is likely to remain sideways with resistance at $46.34 and $47.21. Macro data like new home sale, US Markit Service PMI, continuing jobless claims, GDP Growth rate, and US Fed. Yellen’s speech is expected this week. Retail sales, European Central Bank Draghi Speech, Industrial sale, unemployment rate, business confidence and Inflation rates will be announced from the Eurozone, and we need to watch out.

September futures and options expiry on Thursday and infrastructure output data, can give direction to Indian markets. There can be short covering on Nifty, if Nifty moves above 8900 with volumes. Private Sector banking stocks and selective pharma stocks are expected to trade. Metal stocks and frontline IT stocks are expected to support the market.

Alex K Mathews is the founder of www.thedailybrunch.com

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!