There was a lot of action as Tuesday was a bad day at Dalal Street and Friday was a great day with volatility to the hilt last week

The week gone by was super volatile. In the first three days the markets lost ground and the Sensex was down 979 points while Nifty was down 293 points. The markets staged a mild recovery on the remaining two days and gained 549 points and 182 points respectively. We had during the last week a terrible Tuesday and a terrific Friday.

ADVERTISEMENT

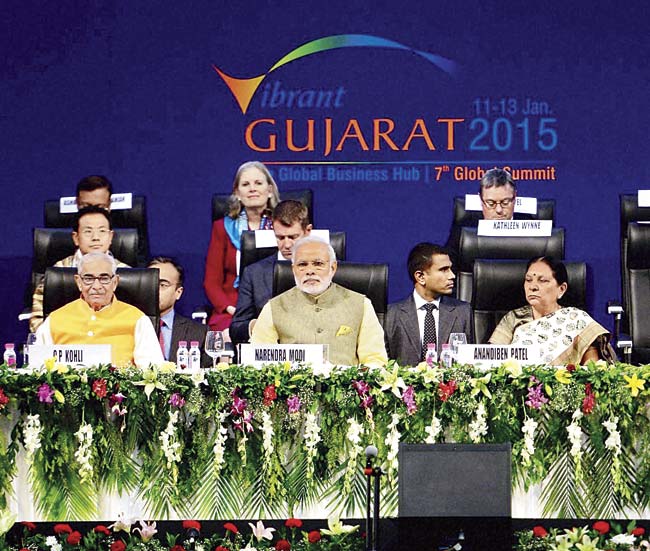

Narendra Modi (c) with Gujarat Governor OP Kohli (l) and Chief Minister Anandiben Patel (r) during the Vibrant Gujarat Global Summit-2015 at Mahatma Mandir in Gandhinagar. Pic/PTI

Performance review

Sensex lost 429.52 points or 1.54 per cent to close at 27,458.38 points while Nifty lost 110.95 points or 1.32 per cent to close at 8,284.50 points. Broader markets saw BSE100, BSE200 and BSE500 lose 1.34 per cent, 1.24 per cent and 1.24 per cent respectively while BSEMIDCAP lost 0.99 per cent and BSESMALLCAP 0.97 per cent.

Top performing sectoral index was BSEFMCG up 0.75 per cent followed by BSEIT up 0.29 per cent. losers were led by BSEMETAL down 4.37 per cent followed by BSEPOWER 2.60 per cent, BSEPOWER 2.54 per cent and BSEBANKEX 2.22 per cent. In individual stocks, the top gainer was BSEFMCG major Hind Unilver up a whopping 14.29 per cent.

This was followed by HPCL 7.80 per cent and Maruti Suzuki 3.15 per cent. In other stocks, Guj State Petronet gained 10.22 per cent while Titan gained 5.80 per cent. Recently announced merger saw Kotak Bank gain 6.91 per cent while ING Vysya gained 6.43 per cent.

The losers were led by BHEL down 7.555; followed by Sesa Sterlite 6.60 per cent and ICICI Bank down 5.63 per cent. Infosys declared results which were better than expectations. Infosys gained 3.03 per cent for the week at Rs 2,074.

Business hub

Narendra Modi inaugurated the three day Vibrant Gujarat yesterday. Global business leaders are expected to visit the fair and make business commitments. Eight nations are participating as partners for the fair. Announcements for ports and infrastructure are expected.

FIIs continued their selling spree and sold shares worth Rs 2,820 crores in the last week while domestic institutions were buyers of Rs 800 crores. The government has after the winter session promulgated eight ordinances and it appears that Congress has decided to oppose these.

In case Rajya Sabha is disrupted there is a certainty of a Joint session of Parliament being convened immediately after the Budget session. The passing of these bills becomes important because the will and intent of the government is necessary to be demonstrated.

While the passing of the ordinances would be crucial, the mere convening of the joint session would send stock markets booming. The failure to call one would amount to there being lack of will power in introducing reforms and would lead to a sharp fall in markets.

The IPO from NCML was withdrawn due to poor response after being extended and price lowered. This writer chose not to write about it in the previous week looking at the poor fundamentals of the issue. It may be said that history repeats itself as in the year 2011-12 there was an issue from Goodwill Hospital and Research Centre Limited.

Look out

The promoters and management of companies going public need to understand that issues that have fundamentals, need to be reasonably priced leaving scope for appreciation post listing and need to be marketed to prospective investors. Global markets too have turned cautious and were in a corrective mode last week.

Dow Jones closed at 17,737.37 points, a weekly loss of 95.62 points or 0.53 per cent. Concerns about Greece, crude oil and gold were some of the issues which kept markets under pressure. Currencies were under pressure and the same was further accentuated after positive growth in the US economy and minutes of the FED meeting were released. The Indian rupee gained 96 paisa or 1.52 per cent to close at Rs 62.32.

The week would be volatile and is likely to see markets gain in the beginning. As the week progresses they would be under pressure due to political news and global cues. Results season has started and they could impact individual stocks. Trade cautiously.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd. Readers are invited to read more about these and other issues on his website https://ak57.in

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only and under no circumstances should be used for actual trading or making investment decisions.

Readers must consult a qualified financial advisor prior to making any actual investment or trading decisions, based on information published here. Any reader taking decisions based on any information published here does so entirely at his or her risk.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!