A Google honcho recently claimed that the company has banned over 2,000 mobile lending apps, but cyber cops say the exercise is pointless as 1,100 illegal Chinese apps entered the Play Store over two months

Thousands of loan apps have surfaced on Google Play Store in the past few years

Poor scrutiny at Google has allowed hundreds of illegal digital lending apps to emerge on the tech giant’s Play Store, said officers from Mumbai police’s Cyber Cell. They said Indian agencies toiled for months to get nearly 1,000 mobile loan apps removed from Google Play Store but about 1,100 such apps, backed by Chinese loan sharks, entered the Android ecosystem in just two months. A senior Google official recently claimed they banned over 2,000 such apps.

Officers investigating the massive loan app scam believe it will hardly make any difference until these non-banking financial companies (NBFCs) adhere to the KYC (know your customer) norms to operate in India which is a must as per RBI guidelines. Sources said Mumbai Cyber Cell and Maharashtra Cyber, a nodal agency, have sought the KYC details of more than 500 apps from Google.

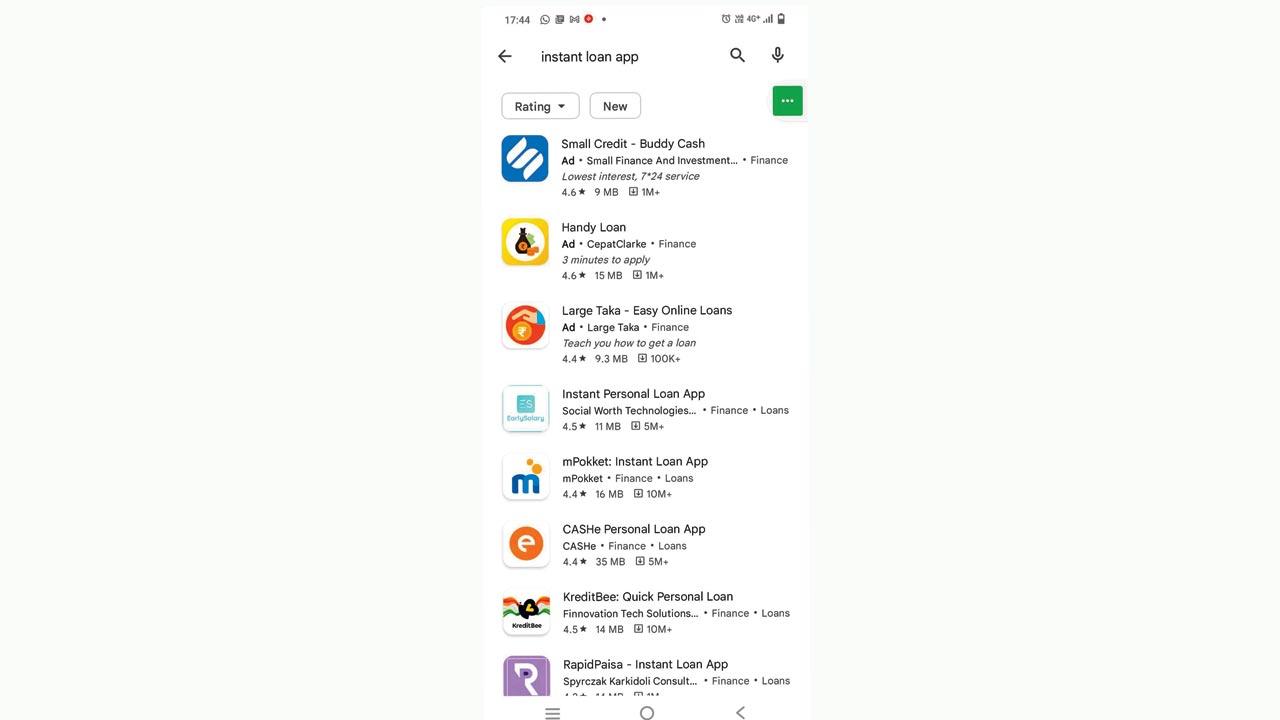

A screenshot of a search for loan apps on Play Store. Representation pic

A screenshot of a search for loan apps on Play Store. Representation pic

Officers investigating the multi-crore mobile loan app scam, in which recovery agents extorted money loan app borrowers by abusing and blackmailing them, said the Chinese crooks have got over 1,100 new instant loan apps on Google Play Store. “Google is not verifying the details of these apps. Instead, it is allowing them to function by charging just 25 dollars for each app,” said a cyber cop.

Also Read: Mumbai: Missing autistic teen found in nullah

Reports said Saikat Mitra, senior director, and head of trust and safety at Google Asia-Pacific, claimed they banned scores of apps after a combination of policy violations, user reports, and collaboration with various law enforcement agencies and policy bodies.

Investigators from the Cyber Cell said Indian agencies worked hard.

Cops want loan apps to strictly adhere to KYC norms. Representation pic

Cops want loan apps to strictly adhere to KYC norms. Representation pic

Putting cold water on the efforts of Indian agencies, the Cyber Cell officers said, scores of dubious apps sneaked past Google Play Store’s filters. “We have also noticed that some apps removed earlier have resurfaced on the Play Store. Also, it has come to our notice that similar email IDs were used in uploading multiple apps on the Play Store,” said an officer.

‘Multiple reminders to Google’

Sources said Mumbai Cyber Cell and Maharashtra Cyber, a nodal agency, have asked Google to share the KYC details of over 500 loan apps. “It appears that KYC was not done properly and only an email ID was provided, which had a server in China. The tech giant is not taking proper details of these apps while allowing them to run on its platform,” said an officer, requesting anonymity.

The police have also asked Google to share the process it followed in letting apps that engage in illegal digital lending, which is not permitted under RBI rules, on the Play Store. As per the norms of the Reserve Bank of India, NBFCs that are into digital lending have to declare their details to the RBI and the info is available on the central bank’s website.

“Google should verify these details with Indian authorities before allowing them to run on their platform, which is not happening. About 99 per cent of illegal digital lending apps having a China link are functioning through the Play Store, and despite multiple reminders and requests made to Google about these apps, there is a lack of cooperation from Google,” a senior officer from Maharashtra police.

Not just Play Store, the Chinese kingpins are also promoting the dodgy loan apps on social media platforms through advertisements. “We are in the process of informing social media platforms to block such pages promoting loans and engaging in other cyber frauds, and some influencers who have been sharing links to these loan app sites to promote them on their pages are also on our radar,” said the officer.

Scam bigger than expected

Amid investigations by the police in multiple states, city cops said that the loan app scam appears to be much bigger than it was initially estimated.

The Delhi police, which has arrested 22 people so far in connection with its investigation, recently said that the fraud could be more than Rs 5,000 crore. Mumbai cops said they will be able to give the exact figure at the time of filing the charge sheet.

“It requires the attention of the central government to ensure that these apps are not allowed on the Play Store or any other platform. Google needs to do a proper KYC of these apps, and they shouldn’t be allowed if they are into digital lending without having permission from Indian agencies,” said a senior home department official, refusing to be identified.

At the time of going to press, Google was yet to respond to mid-day’s email seeking its version.

1,000

No. of apps Indian agencies got removed from Play Store

Some new loan apps on Play Store

. So Cash

. CashBus

. Loan Instant

. Personal App

. Goldsea

. Cash Online

. Instant Loan App

. HappyCash

. Pradhan MantriYojana

. Cash advance Money

. advance Step by step guide

. Acade Me Hub

. Discover Loan

. CASe Personal Loan

. App CASHe

. Cash Manager

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!