Budget 2024: She also said the number of tax filers has swollen 2.4 times and the direct tax collection has trebled since 2014

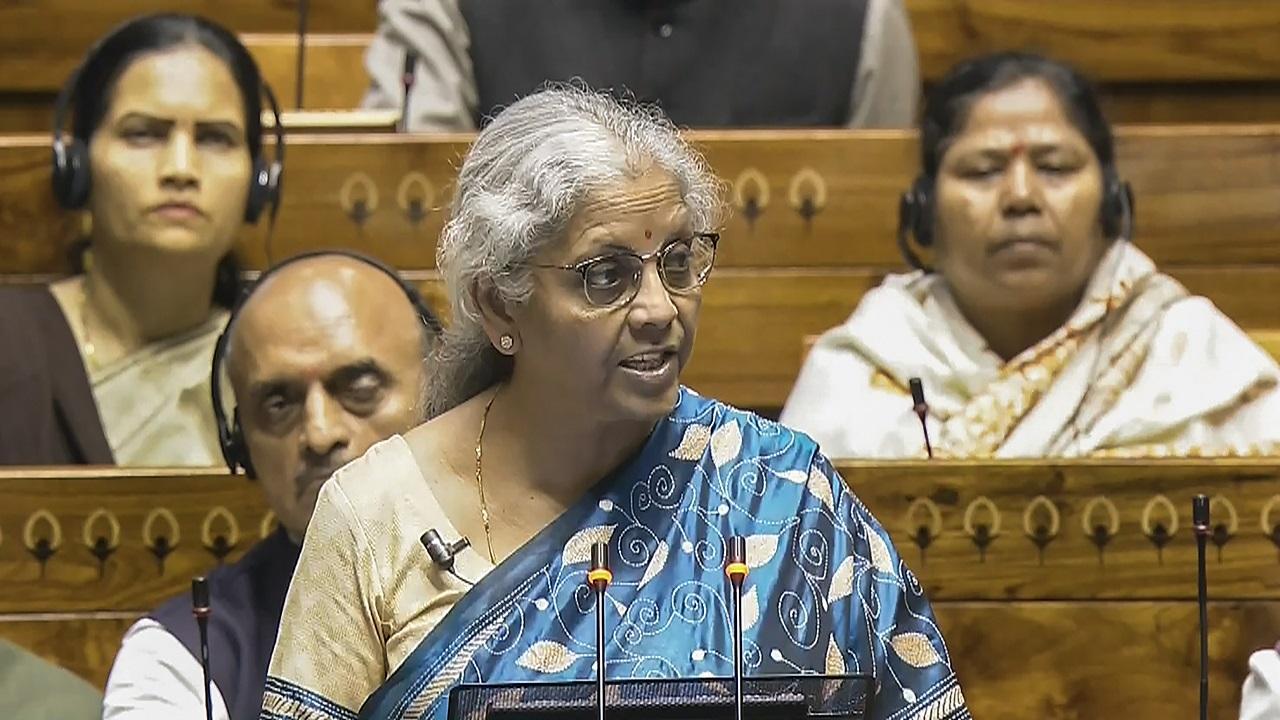

Finance Minister Nirmala Sitharaman. Pic/PTI

Union Finance Minister Nirmala Sitharaman on Thursday said that there would be no changes in tax rates for direct and indirect taxes, including import duties, reported news agency PTI.

ADVERTISEMENT

"I propose to retain the same tax rates for direct and indirect taxes including import duties," Nirmala Sitharaman said in her Budget 2024 speech.

She also said the number of tax filers has swollen 2.4 times and the direct tax collection has trebled since 2014.

The processing time of tax returns has been reduced from 93 days in FY14 to 10 days; and refunds have been made faster, she added.

The government continues to be on the path of fiscal consolidation to reduce fiscal deficit to 4.5 per cent in 2025-26.

Sitharaman added that the tax base of Goods and Services Tax (GST) has more than doubled since FY14.

The fiscal deficit for 2024-25 is estimated at 5.1 per cent of GDP against 5.8 per cent in the current financial year, Finance Minister Nirmala Sitharaman said, reported ANI.

Presenting the interim Budget 2024, Sitharaman said tax receipts for 2024-25 projected is projected at Rs 26.02 lakh crore.

She informed that the fiscal deficit in FY24 is expected at 5.8 per cent of GDP, down from 5.9 per cent estimated earlier.

The Union government's fiscal deficit touched Rs 9.82 lakh crore or 55 per cent of the annual Budget target at December-end 2023. In the corresponding period last year, the deficit was 59.8 per cent of the budget estimates for 2022-23, reported ANI.

Sitharaman also said 50-year interest-free loans of Rs 75,000 crore to be extended to states to realise the dream of a developed India, and added that every challenge of pre-2014 was overcome through our economic management.

The Indian economy under Prime Minister Narendra Modi has witnessed a profound transformation in the last 10 years when the government took several pro-people reforms that were structural, said the Finance Minister Nirmala Sitharaman in her initial remarks.

"In 2014, the country was facing enormous challenges, the government overcame those challenges and undertook structural reforms, pro-people reforms were undertaken, conditions for jobs and entrepreneurship were set in, fruits of development started reaching people at scale, country got a sense of new purpose and hope," Sitharaman said.

"In second term, the government strengthened its mantra and our development philosophy covered all elements of inclusivity, namely social and geographical With a whole of nation approach, the country overcame challenges of the COVID-19 pandemic, took long strides towards Aatma Nirbhar Bharat and laid solid foundations for Amrit Kaal," she added.

She said her government is working towards development which is all round, all inclusive and all pervasive, covering all castes and people at all levels We are working towards making India a Viksit Bharat by 2047.

The interim budget will take care of the financial needs of the intervening period until a government is formed after the Lok Sabha polls after which a full budget will be presented by the new government in July.

(With inputs from PTI and ANI)

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!