The historic Goods and Services Tax (GST) regime yesterday came a step closer to meet its July 1 target of rollout, with the Lok Sabha approving four supplementary legislations

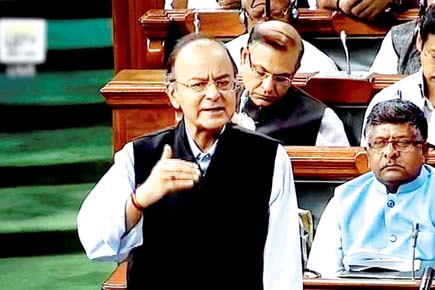

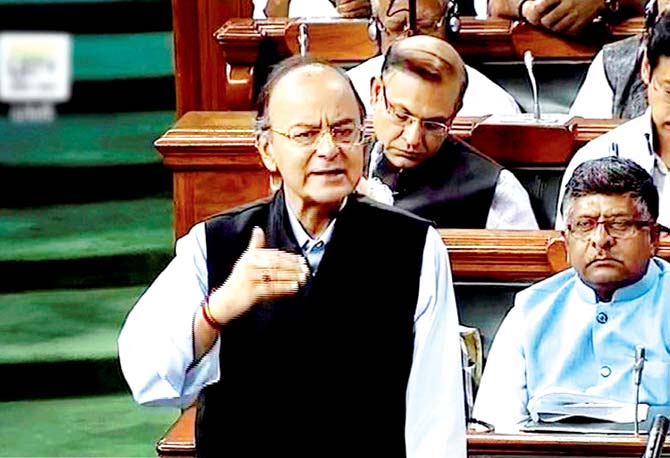

Finance Minister Arun Jaitley said GST will make commodities "slightly cheaper". Pic/PTI

ADVERTISEMENT

New Delhi: The historic Goods and Services Tax (GST) regime yesterday came a step closer to meet its July 1 target of rollout, with the Lok Sabha approving four supplementary legislations.

The Central GST Bill, 2017; The Integrated GST Bill, 2017; The GST (Compensation to States) Bill, 2017; and The Union Territory GST Bill, 2017 were passed after negation of a host of amendments moved by the opposition parties.

Replying to the seven-hour-long debate, Finance Minister Arun Jaitley said the GST, which will usher in a uniform indirect tax regime in the country, will make commodities "slightly cheaper". He said GST rates would depend on whether the commodity is used by a rich person or a common man. Jaitley said once the new regime is implemented, the harassment of businesses by different authorities will end and India will be one rate for one commodity throughout the country. The GST Council has recommended a four-tier tax structure - 5, 12, 18 and 28 per cent. On top of the highest slab, a cess will be imposed on luxury and demerit goods to compensate the states for revenue loss in the first five years of GST implementation.

However, the Central GST (CGST) law has pegged the peak rate at 20 per cent and a similar rate has been prescribed in the State GST (SGST) law, which takes the peak rate to 40 per cent which will come into force only in financial exigencies.

GST will subsume central excise, service tax, VAT and other levies to create an uniform market. It is expected to boost GDP growth by about 2 per cent and check tax evasion.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!