Breaking out from the corrective phase of the last couple of weeks, the markets made new highs

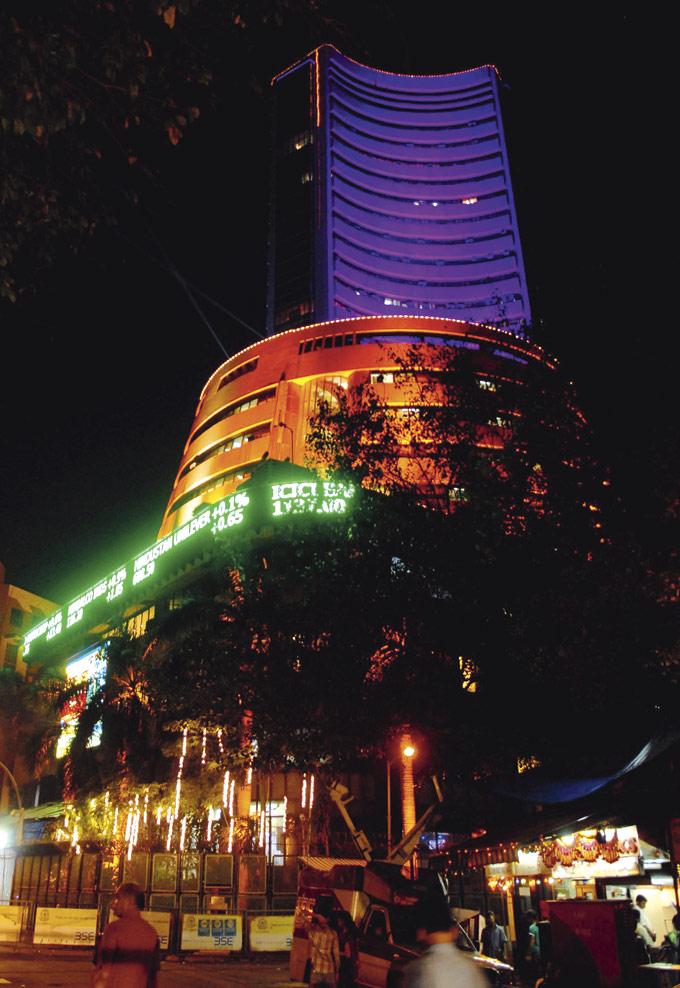

The markets made new highs on every single trading session and broke out from the corrective phase of the last couple of weeks. FIIs were aggressive buyers and helped the rupee strengthen. The BSESensex gained 584.65 points or 2.69 per cent to close at 22,339.97 points.

ADVERTISEMENT

The markets looked up, touching levels not seen for a while

The Nifty gained 201 points or 3.09 per cent at 6,695.90 points. The BSE100, BSE200 and BSE500 gained 3.19 per cent, 3.20 per cent and 3.15 per cent respectively. The Midcap gained 3.21 per cent while the Smallcap gained 2.45 per cent.

The top sectoral gainer was BSEPSU up 8.17 per cent followed by BSEPOWER up 6.71 per cent. Other gainers included BSEBANKEX up 5.67 per cent, BSECONDUR up 5.43 per cent and BSEMETAL up 5.40 per cent. The losers were few and was led by BSEHEALTHCARE down 2.45 per cent and followed by BSEIT down 1.10 per cent and BSETECH down 0.16 per cent.

Gainers

In individual stocks the biggest gainers were the PSU banks which notched up double digit gains. PNB was up 17.18 per cent, Union Bank up 14.37 per cent, SBI up 11.72 per cent and BOB up 11.31 per cent. Other PSU gainers included IOC up 11.56 per cent and HPCL up 9.96 per cent.

Outside the PSU pack new bank licence aspirant IDFC gained 13.41 per cent. The breadth was widespread and there were substantial number of large and medium gainers and few losers. The losers continued to be from the Pharm and IT pack and were led by Dr Reddy’s down 6.04 per cent. Wipro was down 3.02 per cent while Infosys was down 1.09 per cent.

Rupee

FIIs have invested over R 7,500 crore in the previous week and this helped the rupee move up to below R 60 after August 2013. The rupee closed at Rs 59.91 for the week, a gain of Rs 1.02 or 1.67 per cent for the week. March futures expired at 6,641 points, a gain of over 400 points or 6.45 per cent.

This kind of gain has not been seen in a long time and denotes the strength of the rally. The week ahead sees RBI announcing its policy review on the 1st of April. No changes are expected but the RBI chief may give a direction as to what he would do in subsequent meets. Subsequent to this meeting they would now meet bimonthly against the earlier period of every six weeks.

Apathy

There was an IPO from Loha Ispat which was extended due to poor subscription, but still failed to garner adequate support and thus failed. There is a pipeline of issues waiting for the elections to be over so that they would tap the capital markets. However there is so much of apathy towards the markets in general and IPOs in particular that the retail investor just does not participate.

In the recently concluded ETF of PSU units which had raised over R 4,000 crore against the required Rs 3,000 crore there were just about 33,000 retail applicants who subscribed to a total of R 210 crore in the retail segment. This further confirms the fact that retail is just not interested in the market whether it is secondary or retail.

Results

Results season would begin after ten days and it will remain to be seen what companies have done for hedging against the volatility in the rupee. While two quarters ago it was weakness in the rupee which was the issue, this time it would be the strength in the rupee which would be a worry. While the strength would be a worry for exporters it would be more than welcome for importers and by the government whose main concern has been oil imports.

Polls

Election campaigns have taken a turn for the worse with no holds barred in a do-or-die situation. The opinion polls for all that they are worth indicate that the BJP-led NDA would emerge as the single largest front and would in a best case scenario need one or two additional partners while in a worst case scenario could need some more partners to form the government. The fact remains that we will have a stable government and it is this that is being expected and invested in by FIIs.

Investments

The markets are likely to attain new heights and see further investments by FIIs. Retail investors are not yet a part of this rally and the sustainability of the same seems much more than previous rallies.

Key levels for the Sensex are 21,955 and 22,625 while they are 6,585and 6,775 for the Nifty. The support for the Sensex is at 22,228 points, then at 22,049 points, then at 21,990 points and finally at 21,453 points.

It has resistance at 22,407 points, then at 22,586 points, then at 22,826 points and finally at 23,063 points. The Nifty has support at 6,658 points, then at 6,601 points, then at 6,570 points and finally at 6,425 points.

It has resistance at 6,717 points, then at 6,745 points, then at 6,776 points and finally at 6,845 points. While global cues will have some bearing, elections will be overbearing. Ride the rally we have quite a distance to go.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd. Readers are invited to read more about these and other issues on his website https://ak57.in

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only and under no circumstances should be used for actual trading or making investment decisions. Readers must consult a qualified financial advisor prior to making any actual investment or trading decisions, based on information published here. Any reader taking decisions based on any information published here does so entirely at his or her risk.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!