RBI typically conducts six bi-monthly meetings in a financial year, where it decides interest rates, money supply, inflation outlook, and various macroeconomic indicators

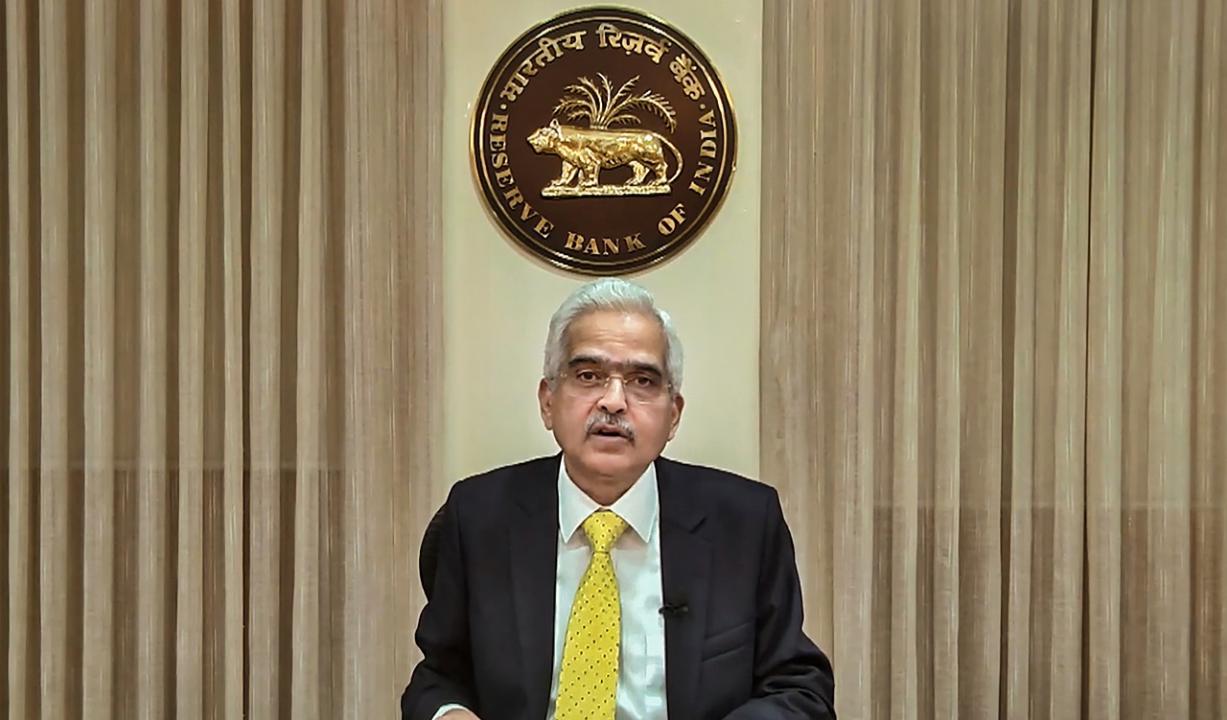

RBI Governor Shaktikanta Das. Pic/PTI

The Reserve Bank of India in its three-day monetary policy committee meeting unanimously decided to keep the repo rate unchanged at 6.5 per cent, something most financial markets had expected.

ADVERTISEMENT

RBI Governor Shaktikanta Das on Thursday at a press conference said, "Monetary Policy Committee decided unanimously to keep the Repo Rate unchanged at 6.50%."

RBI typically conducts six bi-monthly meetings in a financial year, where it decides interest rates, money supply, inflation outlook, and various macroeconomic indicators. The ongoing three-day and the third meeting of 2023-24 started on Tuesday.

In its previous meeting in early June, the central bankâ¿¿s monetary policy committee unanimously decided to keep the repo rate unchanged at 6.5 per cent, something most analysts had expected. The RBI in its April meeting too had paused the repo rate.

The repo rate is the rate of interest at which RBI lends to other banks.

A consistent decline in inflation (currently at an 18-month low) and its potential for further decline may have prompted the central bank to put the brake on the key interest rate again. Inflation has been a concern for many countries, including advanced economies, but India has managed to steer its inflation trajectory quite well.

Barring the April pause, the RBI raised the repo rate by 250 basis points cumulatively to 6.5 per cent since May 2022 in the fight against inflation. Raising interest rates is a monetary policy instrument that typically helps suppress demand in the economy, thereby helping the inflation rate decline.

India's retail inflation was above RBI's 6 per cent target for three consecutive quarters and had managed to fall back to the RBI's comfort zone only in November 2022. Under the flexible inflation targeting framework, the RBI is deemed to have failed in managing price rises if the CPI-based inflation is outside the 2-6 per cent range for three quarters in a row.

This story has been sourced from a third party syndicated feed, agencies. Mid-day accepts no responsibility or liability for its dependability, trustworthiness, reliability and data of the text. Mid-day management/mid-day.com reserves the sole right to alter, delete or remove (without notice) the content in its absolute discretion for any reason whatsoever.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!