Under a multi-crore tax evasion racket in the import of edible oil, unscrupulous importers are evading duty under the cover of consignment despatches to dealers based outside Maharashtra

State investigative authorities have detected a multi-crore tax evasion racket in the import of edible oil. This is one of the biggest scandals in recent times with the Economic Offences Wing (EOW), Mumbai Police, and Sales Tax Department carrying out a joint investigation for the first time in a tax evasion case.

Also Read: Is Jawaharlal Nehru Port Trust a fire disaster waiting to happen?

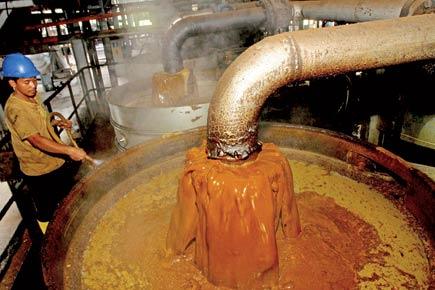

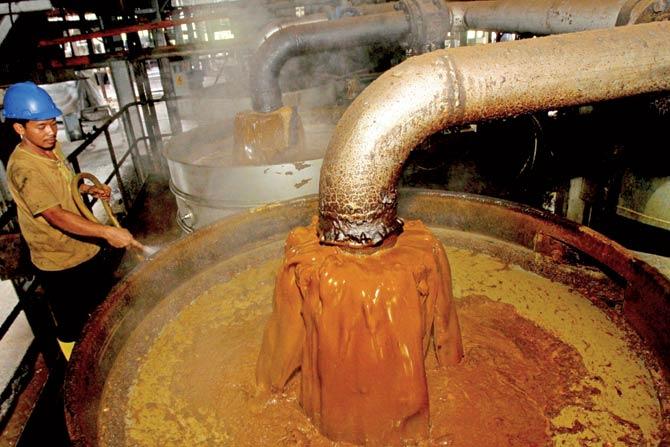

A file picture of the processing of palm oil fruits at a factory in Medan in Indonesia. Palm oil imports have risen as Indonesia and Malaysia had zero export duty on palm products for the last five months to clear surplus stock. Pic/AFP

The probe agencies estimate that of the total 1,60,000 tonnes of Refined Bleached Deodorised (RBD) palm oil imported at the Jawaharlal Nehru Port Trust (JNPT) in the last fiscal, a whopping 75 per cent is being discharged in the name of dummy high-sea buyers existing only on forged documents.

With evasion of a 5 per cent Value Added Tax (VAT) on these consignments valued at Rs 735 crore, the loss to the state exchequer is an estimated Rs 40 crore this year alone. Maharashtra does not apply VAT on consignments whose ownership has been transferred before arrival of goods at the load port, and being disposed, thereafter, outside the state.

According to estimates, palm oil imports have risen as Indonesia and Malaysia had zero export duty on palm products for the past five months to clear surplus stock amid reduced global demand. With a tonne of RBD hovering at a domestic price of Rs 45,900 per tonne, the lowest in recent times, authorities believe that JNPT (Jawaharlal Nehru Port Trust) has now turned into a dumping ground for cheap RBD.

Read Story: Mangroves and flamingos may soon disappear from Uran

The state has now registered an FIR against four middlemen this month under Sections 420 (cheating), 465, 468, 467 and 471 (forgery) of the IPC, for evasion to the tune of Rs 1.3 crore on high seas purchase of Rs 20.59 crore. The role of total six buyers is being investigated while the firms’ total high sea sale of Rs 725 crore over the past seven years is being probed.

A tangled web they weave

These unscrupulous importers evade duty under the cover of consignment despatches to dealers based outside Maharashtra, and do not account for these imports in their books of accounts.

“This malpractice has assumed such an alarming proportion that even the industry’s apex body, the Solvent Extractors’ Association of India (SEA), are themselves urging us to take steps to monitor the situation.

We are looking at various solutions, such as having dedicated border check-posts across Maharashtra and introducing a computerised system to generate e-challans and receipts,” said Commissioner of Sales Tax, Maharashtra, Rajiv Jalota.

The latest scam came to light when a Customs investigation team extracted import details of RBD consignments at JNPT on August 10, 2015. The team inspected the tanking facility of Ganesh Benzoplast (GB) Ltd to get details of the edible oil imports and the process of storage and delivery of edible oil.

Officials said when they came across a sample document of a high-sea sales by Shakti International Pvt Ltd to one Ketan Corporation of Nani Daman, the truck driver and supervisor taking delivery on behalf of Ketan Corporation, fled from the site. The truck details were obtained from the Uran (Navi Mumbai) RTO.

The teams verified details of Ketan Corporation in the books of account of Shakti International and found a connect between the two. Another team visited Nani Daman to verify registration details of Ketan Corporation; they found a computer class being run at the place of business registered with the VAT authorities.

The local VAT authorities found Ketan had filed nil returns lately. “Our investigations established that Haresh and Yash Kesaria are selling goods of Ketan Corporation in the local market without paying VAT. Mahindra Hirve and Ketan Sawani, who are the proprietors of Ketan Corporation, are also involved in the evasion.

Hence an FIR has been lodged against the four for evasion of local VAT,” a sales tax report reads. It is believed that this sudden increase in the edible oil imports at JNPT is additionally on account of surging dummy high sea sales and bogus buyers.

“Importers of RBD palm oil at JNPT port are engaged in unscrupulous business practices by evading payment of sales tax, seriously affecting the genuine importers and processors of vegetable oil in Maharashtra and at the same time the state is deprived of sales tax revenue,” said BV Mehta, executive director of The Solvent Extractors’ Association of India.

The reason for the malpractices, importers say, are obvious: a complicated tax structure, volatility of prices of palm oil in the international market, depleting margins, there is a tendency of edible oil traders to evade taxes, especially sales tax.

“Unfortunately, this evasion of sales tax by some players creates distortion in the market, sets a bad example for others, while making business of honest players unviable and driving them out of business,” said Gyan Chordia, an importer and a former Director of Ganesh Benzoplast.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!