Basic exemption limit raised to Rs 3 lakh from existing Rs 2.5 lakh and standard deduction of Rs 50,000 allowed under new tax regime; expert says move a push to make salaried class shift from old one

People pass by the BSE, with screen displaying the news about the Budget, on Wednesday. Pic/Atul Kamble

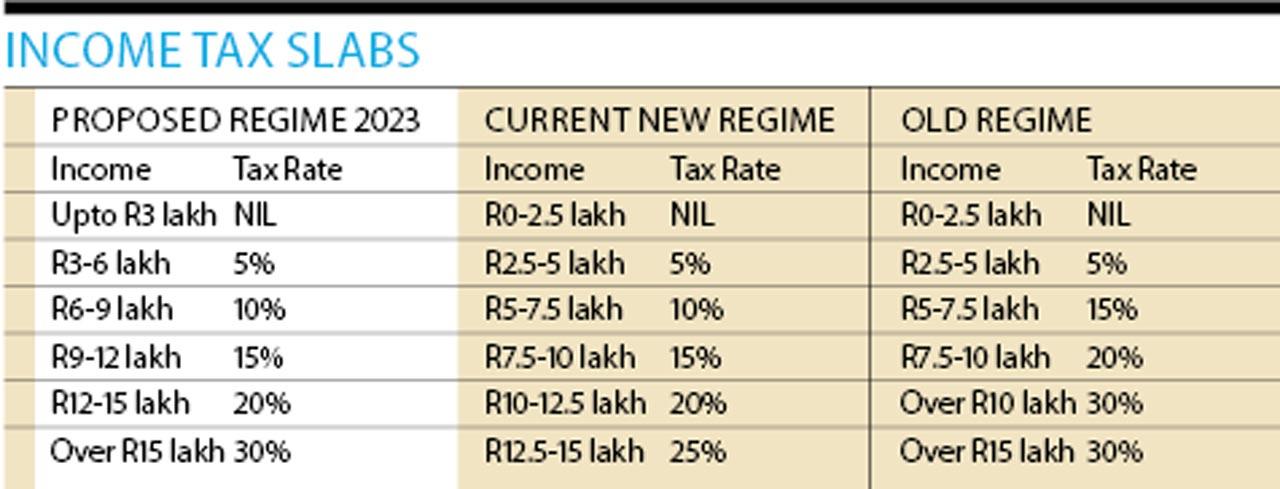

Finance Minister Nirmala Sitharaman on Wednesday announced new tax slabs with no tax for those earning up to Rs 7 lakh a year, under the new regime. In what is being seen as a push for salaried class taxpayers to switch to the new tax regime, where no exemptions were provided, the finance minister in her budget for 2023-24 allowed a standard deduction of Rs 50,000 under the new regime.

ADVERTISEMENT

She, however, made no changes for those who continue in the old regime that provides for tax exemptions and deductions on investments and expenses such as HRA as well as no tax on income up to Rs 5 lakh.

The basic exemption limit in the new tax regime has been raised to Rs 3 lakh from Rs 2.5 lakh—the basic exemption limit prescribed in the old tax regime.

The move will lead to a saving of Rs 33,800 for those who earn up to Rs 7 lakh annually and opt for the new tax regime. Those with income up to Rs 10 lakh would save Rs 23,400, and the saving would stand at Rs 49,400 to those earning up to Rs 15 lakh.

Sitharaman also reduced the surcharge from 37 per cent to 25 per cent for high net worth individuals with income above Rs 2 crore. This would translate into a saving of around Rs 20 lakh for those with income of about Rs 5.5 crore.

Under the revamped new tax regime, no tax would be levied for income up to Rs 3 lakh. Those with income between Rs 3-6 lakh would be taxed at 5 per cent; Rs 6-9 lakh at 10 per cent, Rs 9-12 lakh at 15 per cent, Rs 12-15 lakh at 20 per cent and those with income of Rs 15 lakh and above will be taxed at 30 per cent.

“I propose to extend the benefit of standard deduction to the new tax regime. Each salaried person with an income of Rs 15.5 lakh or more will thus stand to benefit by Rs 52,500,” the finance minister said.

Also Read: Budget 2023: FM’s Pathaan and PM’s Tiger deliver box-office budget

With effect from April 1, these slabs will be modified as per the Budget announcement.

This story has been sourced from a third party syndicated feed, agencies. Mid-day accepts no responsibility or liability for its dependability, trustworthiness, reliability and data of the text. Mid-day management/mid-day.com reserves the sole right to alter, delete or remove (without notice) the content in its absolute discretion for any reason whatsoever

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!