Sanctioning of mega projects worth Rs 1,50,000 crore occurred amid absence of elected representatives; former Opp leader terms it ‘looting'

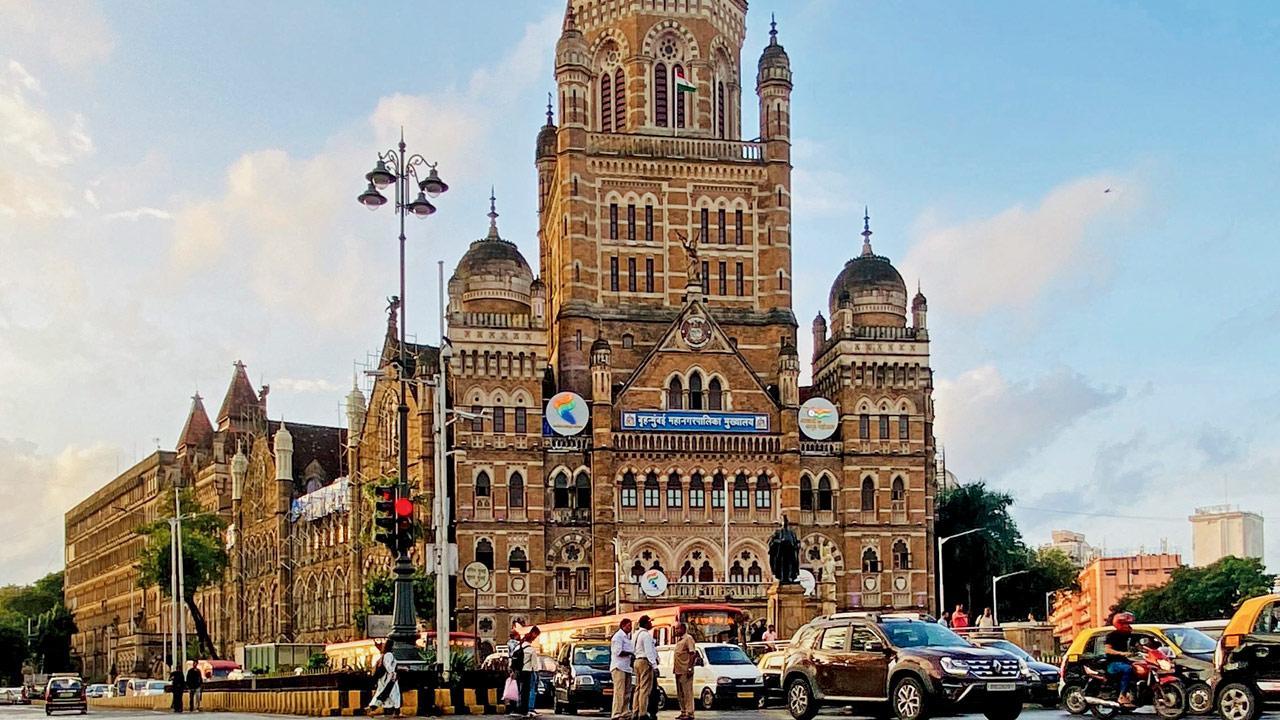

The municipal corporation had approximately R81,500 crore in fixed deposits at the end of September. File Pic/Shadab Khan

For the past two-and-a-half years, the amount of money in BMC’s fixed deposits (FDs) has shrunk by Rs 10,000 crore. During the Shiv Sena (UBT)’s Dussehra rally, party chief Uddhav Thackeray said the civic body issued work orders worth over Rs 3 lakh crore and spent almost half the money in its FDs. However, the BMC still had approximately Rs 81,500 crore in FDs at the end of September.

ADVERTISEMENT

In March 2011, BMC had Rs 23,330 in FDs, which increased to Rs 72,000 crore in March 2018. By March 2022, it had reached almost Rs 92,000 crore. The terms of corporators ended that month and in June 2022, the state government was toppled. Iqbal Singh Chahal, the then-municipal commissioner, was subsequently named the civic administrator under the guidance of the state government.

Chahal and his successor, the incumbent administrator Bhushan Gagrani, sanctioned mega projects worth Rs 1,50,000 crore to date. A civic official said, “Though the projects have been sanctioned, they all are in the initial stages so there isn’t much stress on fixed deposits yet. But, there will be some eventually when the projects start in full force. In March 2024, the BMC broke FDs to disburse Rs 1,000 crore to the MMRDA for ongoing Metro projects.” The BMC was supposed to disburse an additional Rs 3,959 crore to the authority in this financial year.

As the BMC couldn’t hike water bills and property tax for the past few years, it solely depends on the compensation in lieu of octroi from the state government and fixed deposits. The income sources of the corporation have shrunk and to meet the expense of administration and project works of around Rs 60,000 crore in 2024-25; the civic body will depend on Rs 22,000 crore from FDs. In 2023-24, the civic body fetched Rs 12,734 crore from special funds, including FDs.

Ravi Raja, former leader of Opposition in the BMC, said, “This is the looting of the BMC. In the absence of corporators, there are no checks and balances. The administrator himself proposes the projects and sanctions them. No one is there to ask questions and raise doubts as to whether the projects are feasible. The BMC wasted Rs 1,700 crore on beautification. There were 20 to 25 per cent cost escalations in many projects and FDs were used extensively.”

Why amount in civic body’s FDs has shrunk

The civic body hasn’t been able to increase water bills and property tax for the past few years, making it dependent on compensation in lieu of octroi from the state government and FDs to fund works. Since March 2022, the BMC administrator has sanctioned mega projects worth Rs 1,50,000 crore, including Rs 18,000 crore for concreting roads and Rs 27,000 crore for sewage treatment plants. Apart from these works, several smaller ones have been authorised. In March this year, FDs were broken to disburse Rs 1,000 crore to the MMRDA.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!