The pressure piles on, in a topsy-turvy week

Nift was under pressure last week, due to poor quarterly earnings and weak world market cues. It finally closed at 7738. During this period, Nifty made a high at 7890 and a low at 7678. Going forward, quarterly earnings are a big trigger for the markets, and, Nifty may remain in a tight range of 7600- 7980. A decisive move above the resistance level seems to be difficult because of a lack of fresh triggers.

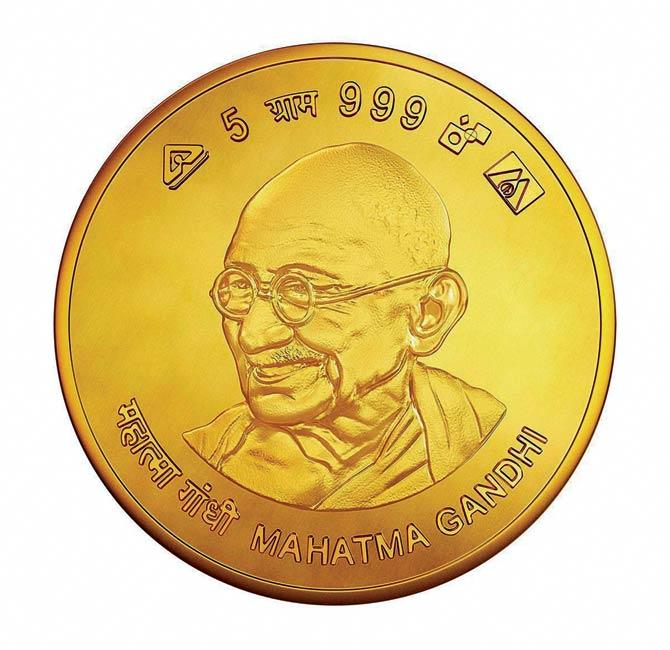

The government launched gold coins bearing Mahatma Gandhi’s image, on the occasion of Akshaya Tritiya. Pic/PTI

The Japanese Yen is likely to play a crucial role in determining world equity markets. It has support at 105.45 and resistance at 107. The Japanese Yen’s appreciation is a major concern for Japanese exporters and investors, expecting further stimulus programs in the near term by the Japanese Central Bank. To keep the US dollar steady, there are strong possibilities that the Federal Reserve may hike the interest rate in June.

On Friday, Dow Jones closed higher on news that non-farm payrolls increased less than economists expected, which helped the VIX to come down by 7.8 per cent at 14.72, which indicates low volatility in the days to come. Dow Jones has strong support at 17578 and resistance at 17866, a move above this resistance level can take the Dow towards the 18000 mark, which can further fuel global equity markets. The Domestic Nikki Manufacturing PMI was way below analysts expectation, recording 50.50 growth in April, versus 52.40 in March. Chinese Manufacturing activity also recorded a sharp decline in April, which kept the Chinese markets under tremendous pressure.

Gold

The Lower House of Indian Parliament passed the Insolvency and Bankruptcy code. This will, it is expected, reduce the time it takes to wind up a company and recover dues from a defaulter. According to central bank estimates, India’s bad debts, restructured loan and written off assets rose to $131 billion as of September 30. On Friday, we saw substantial buying in Public Sector Banks stocks. According to CLSA, the Chinese banks are holding bad loans worth $1 trillion. Banking Nifty has support at 16150 and 15999. Banking Nifty has resistance at 16709 and if this level has taken off, then, we can expect smooth sailing of Banking Nifty towards 17172.

There are many companies supposed to come out with their quarterly earnings. These include 8K Mills, HUL, Sangam India, Ador Welding, Century Ply, Dhamput Sugar, Eid Parry, NIIT Ltd, Zee Entertainment, Apollo Tyres, Asian Paints, Havells, KTK Bank, Oriental Bank of Commerce, Dr. Reddy, Glenmark, MRPL, Nestle India, Polaris, BOB, Bayer Crop, Cadila Health, Central Bank, Dena Bank, UBL, UCO Bank, Zuari, Zuari Global and others. The yellow metal is firm ahead of Akshaya Tritiya. The commodity has resistance at $1306 per troy ounce and support at $1296 and $1285 per troy ounce. The world’s gold demand and weak US dollar are also supporting factors for the market.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!