It's never too early to learn about the value of money, and a four-session online workshop will show young adults the ropes by educating them about key financial concepts

After working as an investment banker for three years at a multinational investment bank in London, Minakshi Agrawal Todi decided to globetrot. In the middle of her travels, she encountered backpackers as young as 18 who were in debt. It got her to think about why there was so little financial literacy. "I realised that no matter what your occupation is, we are ultimately working to make money. So everyone needs to learn how to manage it. Also, people don't know what other avenues are there, outside of their job," she shares. To tackle that, this year, she started The Finance Box, a platform that offers workshops on all things money.

ADVERTISEMENT

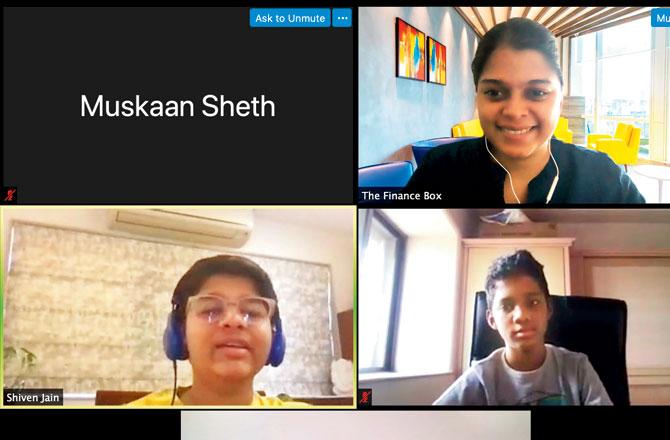

Over four days, starting this Thursday, Todi, who currently teaches at the ISME School of Management and Entrepreneurship in the city, will conduct an online financial literacy workshop for young adults (11 to 15 years). She will start with introducing them to money and its value, spending, and budgeting, and keeping track of it, along with the different modes of payment.

The sessions will be held on Zoom

Todi asserts that her teaching methods are user-friendly. "There are case studies which are essentially stories, in addition to fun activities. One, for instance, is where I give them a scenario of the pandemic and a mental budget of Rs 15,000. They are then tasked with using the money to stock up on groceries for home by adding it to their shopping basket on e-commerce websites," she informs.

Through this exercise, kids learn how much things really cost - such as the price of a tomato. In another activity, Todi asks attendees to come up with ideas for their own business. Other sessions will highlight banking and savings, entrepreneurship, and borrowing and investment.

The size of the class won't exceed 12 students. Having conducted one edition of the workshop for teens in Diwali, Todi informs that she has a good re-join ratio. "Kids themselves come up with interesting ideas. For the budgeting exercise, one young attendee said she'd keep 10 per cent of the money aside for medicines because there's a pandemic, which was smart to think about."

Teen-y tiny tips

>> A teenager must think about saving. Quoting Warren Buffet, Todi says, "Always pay yourself first. Save before you spend." So, if you have Rs 100, don't spend Rs 99 and be content with the fact that you've managed to save Rs 1. Instead, save Rs 10 first and then spend Rs 90.

>> Nowadays, young kids are getting credit cards, but it is important to not see it as free money. Understand how borrowing and interest works.

>> With respect to your career, keep your options open, and don't follow the mentality around you. Be it entrepreneurship or a job, there are pros and cons to both career paths.

On: December 24 to 27, 5 pm

Log on to: thefinancebox.in

Cost: Rs 1,999 (for four sessions)

Keep scrolling to read more news

Catch up on all the latest Mumbai news, crime news, current affairs, and a complete guide from food to things to do and events across Mumbai. Also download the new mid-day Android and iOS apps to get latest updates.

Mid-Day is now on Telegram. Click here to join our channel (@middayinfomedialtd) and stay updated with the latest news

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!