The National Pension System, or NPS, is a government-backed retirement investment scheme.

NPS

Are you dreaming of building a massive corpus by the time you retire? While it may seem like a distant dream, it is possible with the right investment strategy and discipline. One such investment that can help you achieve this ambitious goal is the National Pension System (NPS). This blog explores how NPS can help you build a substantial corpus at the time of maturity.

ADVERTISEMENT

What is NPS?

The National Pension System, or NPS, is a government-backed retirement investment scheme. Launched in 2009, the concept of this scheme is to provide every citizen of India with a pension and old-age security. To become eligible for NPS, you need to meet the following prerequisites:

- Age: 18 to 70 years - Indian citizens and Non-Resident Indians (NRIs)

- Minimum Investment: Rs. 500 (one time) and Rs. 1,000 (annual)

- KYC Compliance: You must comply with KYC (Know Your Customer) regulations.

- Eligibility Exclusions: Hindu Undivided Families (HUFs) are not eligible to invest in NPS.

Features and Benefits of NPS

NPS offers many key features and benefits that make it a desirable investment option. Here are a few points that make NPS an ideal choice for your investment plan:

- Low Investment Cost: The low minimum investment amount makes NPS accessible to everyone, allowing personal contributions to grow significantly over time through the power of compounding, ultimately building a substantial retirement corpus.

- Flexibility: NPS is suitable for individuals across various professions and locations, offering flexibility by accommodating job changes for subscribers.

- Regulatory Oversight: Regulated by the Pension Fund Regulatory and Development Authority (PFRDA), NPS is highly secure and transparent. You can open an NPS account online through a PFRDA-approved Bank like Kotak Mahindra Bank. The process is hassle-free, and you can start investing with a minimum contribution of Rs. 500.

- Tax Benefits: The NPS offers tax benefits under Section 80C, Section 80CCD(1), Section 80CCD(1B), and Section 80CCD(2) of the Income Tax Act.

- Four Fund Options: NPS offers four fund options: Equity Funds, Corporate Debt Funds, Government Securities Funds, and Alternate Investment Funds. These options enable you to select a portfolio that aligns with your risk appetite and financial goals.

- Two Types of Accounts: NPS introduces two types of accounts: Tier-I and Tier-II. Tier-I accounts are retirement accounts with restrictions on withdrawals, while Tier-II accounts are more flexible and can be used for investment purposes. Notably, you can only open a Tier-II account if you already have a Tier-I account.

- Portable: NPS is a portable scheme that allows you to change jobs or locations without impacting your investments.

How Can NPS Help You Procure a Substantial Retirement Corpus at Maturity?

To achieve a substantial retirement corpus at the age of 60, you need a strategic investment approach, and NPS can be a valuable option. Here’s a detailed roadmap on how NPS can help you achieve this goal.

Step 1: Calculate Your Monthly Contribution

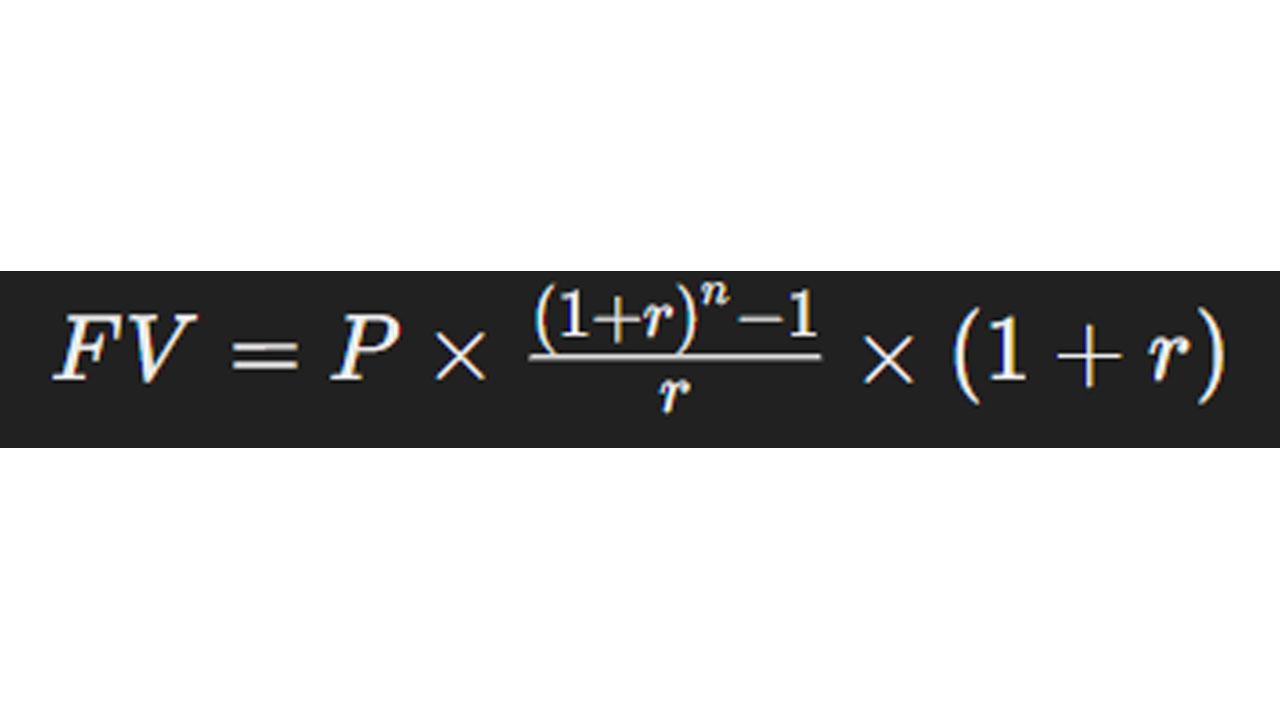

Invest a fixed amount every month in your NPS. The amount you need to contribute depends on your investment duration, the expected return on investment and the retirement corpus you wish to have. You can calculate the required monthly contribution using the formula for Future Value below, assuming an average annual return of 12%:

Where:

- FV = Future Value (Corpus amount you wish to have)

- P = Monthly investment (to be calculated)

- r = Monthly rate of return (annual return divided by 12)

- n = Total number of months (years × 12)

For calculation, you can also use Kotak Bank’s NPS calculator as well.

Step 2: Choose Your Investment Options

Under NPS, there are four fund options: Equity Funds, Corporate Debt Funds, Government Securities Funds, and Alternative Investment Funds. These options allow you to tailor your portfolio according to your risk appetite and investment goals. To retire by the age of 60, a mix of equity and debt funds can help balance risk and return.

Step 3: Take Advantage of Tax Benefits

NPS offers significant tax benefits by helping you save on taxes while enhancing your savings. Here are some of the tax benefits available:

- Section 80CCD(1): Deductions of up to 10% of the Basic salary and Dearness Allowance for salaried employees within the overall ceiling of Rs. 1.5 Lakh under Section 80CCE

- Self-Employed Individuals: Deductions of up to 20% of gross annual income as per Section 80CCD(1) with a maximum of Rs. 1.5 Lakh.

- Employer Contributions: Employers can also contribute to an NPS account, and such contributions are allowed as a deduction under Section 80CCD(2).

Step 4: Tracking the Investments and Redirection

Regularly review and monitor your NPS investments and adjust them based on your financial goals and risk appetite. Ensure you consistently check your account balance, investment portfolio, and returns.

Conclusion

Planning to accumulate a substantial corpus at the time of maturity requires a solid investment strategy, discipline, and patience. NPS can be a viable option for long-term wealth creation, offering attractive tax benefits and market-linked returns. Following the steps outlined in this article and maintaining discipline, you can achieve your financial goal and enjoy a secure retirement. Start planning your retirement and growing your wealth with NPS today!

Disclaimer:The information provided on the Website does not constitute investment advice, financial advice, trading advice, or any other form of advice, and you should not interpret any of the financial content as such. Please conduct your own due diligence and consult with a financial advisor before making any investment decisions. Midday does not endorse or promote any such activities, and you access them at your own risk, fully understanding the monetary and legal consequences involved. Midday shall not be held responsible for any losses you may incur as a result of using any such apps or websites.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!