Contrary to popular belief, gold does not really behave as a safe haven asset these days.

ADVERTISEMENT

Gold prices started the year with a bang, almost touching a new record high in May. However, the rally got rejected and the precious metal has been drifting lower since, falling back into the sideways range that has contained the price action since 2020.

What have we seen in the gold market lately?

Contrary to popular belief, gold does not really behave as a safe haven asset these days. Ever since the pandemic, it’s had a strong positive correlation with stock markets, which means it doesn’t provide much protection in case there is a sell-off in riskier assets.

It has not been a great hedge against inflation either in this cycle. That’s because central banks have raised interest rates aggressively to combat inflation, and higher rates make bullion less attractive, as the precious metal does not pay any interest to hold.

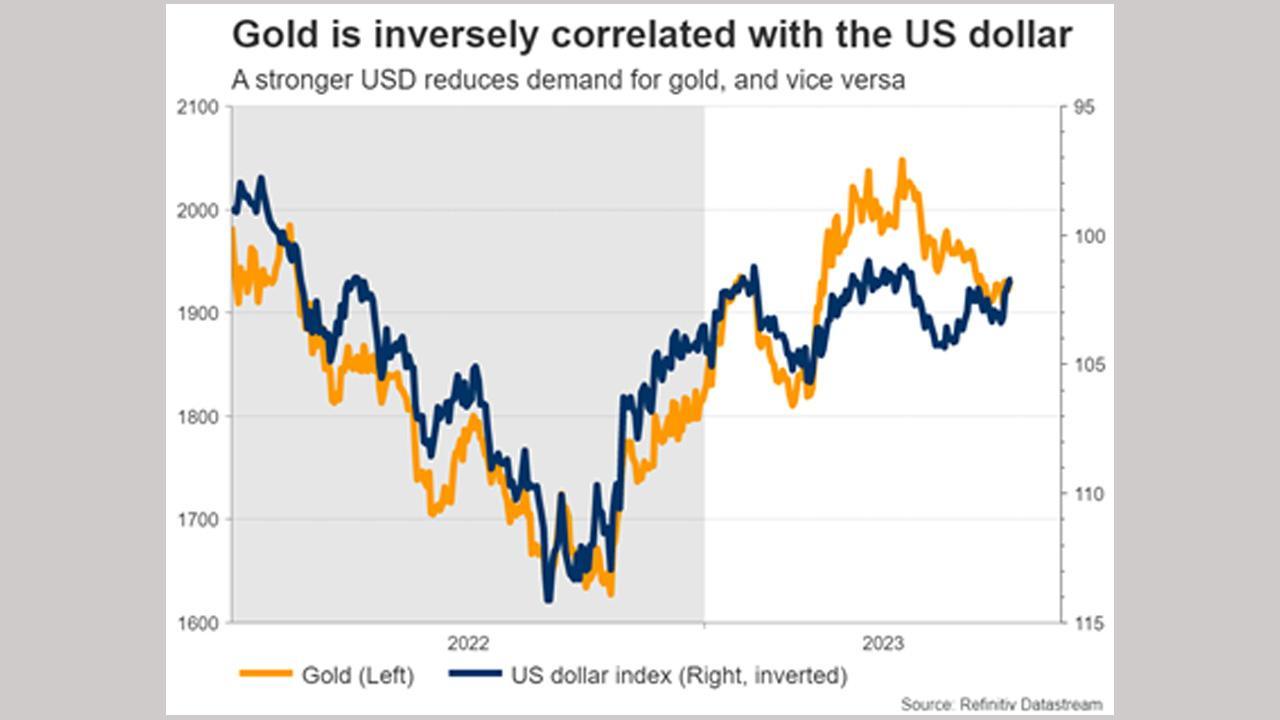

Hence, gold has turned into a mirror reflection of interest rates, effectively moving in the opposite direction of US yields. Another factor that affects gold is the US dollar, and this relationship is negative as well. Since gold is denominated in US dollars, a stronger greenback makes it more expensive for foreign investors to buy the metal, and vice versa.

In other words, gold’s fate is inversely linked to interest rate expectations and the US dollar, so predicting the direction of these assets is essential for forecasting how bullion will perform in the future.

Predictions for the upcoming months

In this sense, the risks surrounding gold over the coming months seem tilted to the downside. For now, the US economy appears resilient. Economic growth is running around 2%, the housing market has staged an impressive recovery, and the labor market is in great shape. All this suggests that interest rates are likely to remain elevated for a longer period.

This is a problematic environment for gold, as it implies higher bond yields and a relatively strong US dollar, both of which exert downward pressure on the yellow metal — a gravitational pull almost.

What to look out for in the charts

Looking at gold charts the most important region to watch on the downside is $1,900 per ounce, as a weekly close below that zone could turn the short-term outlook more bearish, adding fuel to the latest retreat.

Will gold go up again in 2023?

For gold to resume its journey back to record highs, it would probably require recession concerns to resurface. A weaker economic data pulse in the US could feed speculation that the Fed will cut rates soon, pushing yields and the dollar lower, which in turn could allow gold to shine once again. That said, we are not at this stage yet. This might be a story for around the end of the year, or beyond.

About XM

XM is a multi-asset, global trading platform, that has the vision to provide the best services any trader needs across the whole spectrum of trading, varying from a multi-awarded customer care, the safest and fastest local payment methods, reliability, fairness, lightning execution of trades with accurate pricing, totalling to a world class trading experience.

Interested in trading precious metals with XM? View prices and conditions for trading gold.

To learn more about XM, visit: their website XM.com.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!