Your loan eligibility is determined by your CIBIL Score. The first credit rating agency in India, CIBIL (Credit Information Bureau India Ltd.), assesses your creditworthiness based on your credit history, loan/credit card repayment habits, frequency of loan applications, number of ongoing loans, and other factors.

ADVERTISEMENT

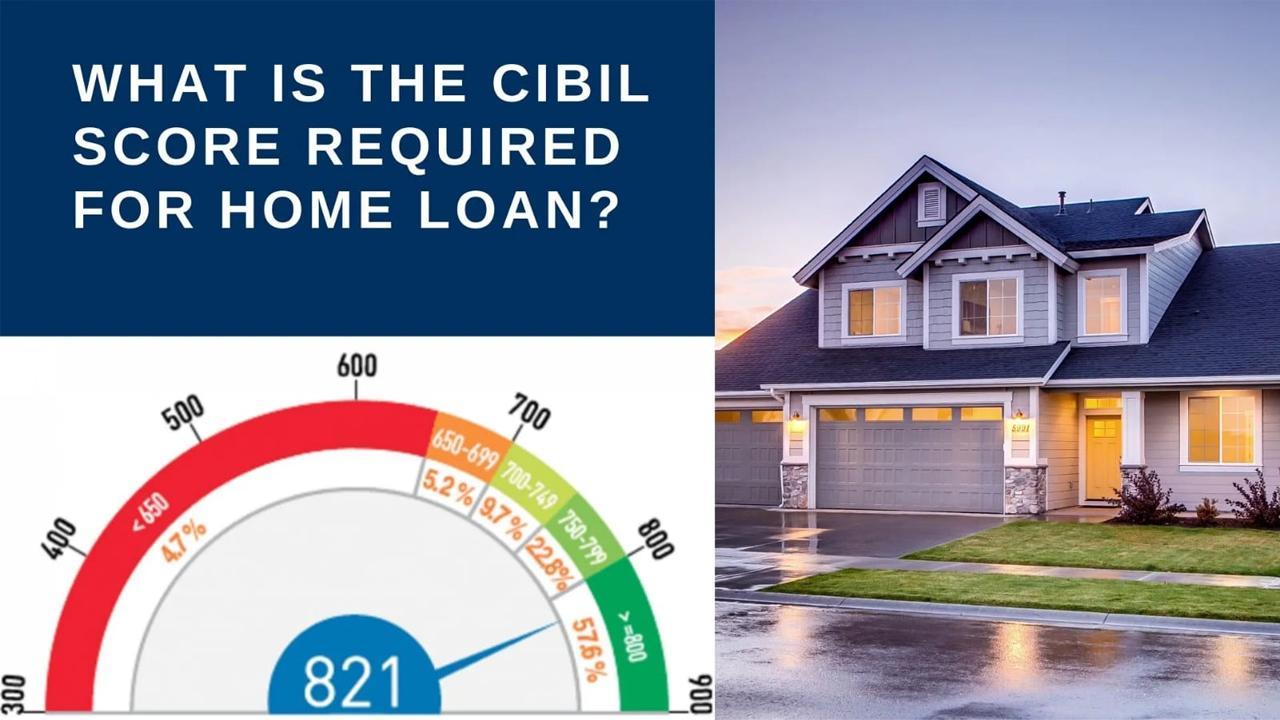

The CIBIL Score is given on a scale of 300 to 900, with 900 being the highest and 300 being the lowest. A CIBIL Score of 750 is usually required for a borrower to be considered for a loan.

CIBIL Score for Home Loan

If you want to avoid being turned down for a loan, you should be aware of the importance of a CIBIL score in the loan approval process.

The first thing a lender looks at when you apply for a loan is your credit score. Your loan application is likely to be rejected if you have a low credit score. However, if you have a good credit score (over 750), the lender will look into your application further to determine your creditworthiness before making a final lending decision. Your credit score provides lenders with an instant assessment of your likelihood of default based on your repayment history.

What are the uses of CIBIL Score for home loans?

Home loans are typically provided by banks or financial institutions, and as lenders, they must ensure that all relevant risks are minimized. This is where your CIBIL score is useful.

TransUnion CIBIL Limited, a credit information company, generates credit history reports for each individual and commercial organization once a month.

CIBIL reports helps make better judgment of one's lending history and decide whether the home loan application is accepted or rejected.

How is Credit Score Calculated?

Credit scores are determined by factors such as:

Your financial history.

The total amount owed to various lenders, or the credit balance.

The total amount of credit you've used.

Any new credit you've applied for or been approved for.

The credit distribution (credit composition in terms of different types of loans).

How do lenders make use of CIBIL scores?

Before sanctioning a loan, lenders had to make a partly subjective internal assessment and conduct background checks. With the help of a credit score and a credit report, however, obtaining accurate, data-based credit information on the applicant has never been easier.

CIBIL keeps track of customer credit activity in a database. Their credit score is calculated using this information.

Lenders may view you as a high-risk customer if your credit score is low (less than 700), and they may refuse to approve your loan application. With a high credit score, lenders will consider you a low-risk customer.

How to Improve Your Credit Score for a Home Loan?

Here are the steps to meet the CIBIL score requirements for your home loan application.

- Check your CIBIL score before applying for a home loan or any other type of loan to reduce the chances of your loan application being rejected

- If a lender rejects your application for a home loan, work on improving your CIBIL score before applying to another lender.

- Make it a priority to manage any unsecured loans you have, such as personal loans or credit cards. If at all possible, close them with a high credit limit. This is due to the fact that lenders can assess your total outstanding debt balance based on your Debt to Income (DTI) ratio.

Also Read:

Minimum Documents Required for Home Loan

Home Loan Without Income Proof

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!