Thanks to bad credit loans, accessing financing when you have a low or non-existent credit score is no longer an uphill task.

ADVERTISEMENT

Loans for bad credit are designed with bad credit borrowers in mind and feature inclusive terms that don’t discriminate because of your previous financial issues. The best personal loans for bad credit are approved based on affordability, and you can access them through loan providers. Loan providers connect you to direct lenders likely approve your application whether you’re looking for bad credit car loans, installment loans for bad credit, or bad credit loans guaranteed approval alternatives. Let’s explore the top providers you can use to apply for online loans for bad credit today.

Best Bad Credit Loans Online 2023 – Quick Overview

- Green Dollar Loans: Overall Best Loans for Bad Credit Ideal for Unemployed Applicants Generating at Least $1k Per Month

- Heart Paydays: Best for Personal Loans for Bad Credit With 3-24 Months to Repay up to $5000

- Big Buck Loans: Best for Bad Credit Car Loans with APRs ranging from 5.99% to 35.99%

- 50K Loans: Best for Installment Loans for Bad Credit with Weekly, Fortnightly, and Monthly Repayments

- Viva Payday Loans: Best for Bad Credit Loans Guaranteed Approval Alternatives with Quick and Easy Online Application

Bad Credit Loans Guaranteed Approval: Choose From the List of Top 5 Lenders and Get Approved Now

Green Dollar Loans: Overall Best Loans for Bad Credit Ideal for Unemployed Applicants Generating at Least $1k Per Month

Quick Ratings

- Decision Speed: 9/10

- Loan Amount Offering: 9/10

- Variety of Products: 9/10

- Acceptance Rate: 9/10

- Customer Support: 9/10

Green Dollar Loans features a fast online process that connects you to inclusive lenders who consider all income sources and offer fast approvals and quick payouts.

Highlights of Loans for Bad Credit Ideal for Unemployed Applicants

- Fast online process

- Inclusive lenders

- All income sources considered

- Fast approvals

- Quick payouts

Eligibility for Loans for Bad Credit Ideal for Unemployed Applicants

- 18+ years

- Steady income

- Government-issued ID

Fees on Loans for Bad Credit Ideal for Unemployed Applicants Generating at Least $1k Per Month

- Late payment fee

- 99% to 35.99% APR.

Heart Paydays: Best for Personal Loans for Bad Credit With 3-24 Months to Repay up to $5000

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 8/10

- Variety of Products: 9/10

- Acceptance Rate: 9/10

- Customer Support: 8/10

Heart Paydays’ smooth online process provides free access to specialized lenders offering small to medium-sized loans with immediate responses and quick disbursements.

Highlights of Personal Loans for Bad Credit

- Smooth online process

- Free access to specialized lenders

- Small to medium-sized loans

- Immediate feedback

- Quick disbursements

Eligibility for Personal Loans for Bad Credit With 3-24 Months to Repay up to $5000

- Adult above 18

- US citizen/resident

- Active US bank account

Fees on Personal Loans for Bad Credit With 3-24 Months to Repay up to $5000

- APR from 5.99% to 35.99%

- Missed payment penalty

Big Buck Loans: Best for Bad Credit Car Loans with APRs Ranging from 5.99% to 35.99%

Quick Ratings

- Decision Speed: 9/10

- Loan Amount Offering: 8/10

- Variety of Products: 8/10

- Acceptance Rate: 8/10

- Customer Support: 8/10

Big Buck Loans provides a hassle-free process that connects you to direct lenders offering affordable loans with prompt feedback and reasonable APRs, no matter your credit score.

Highlights of Bad Credit Car Loans

- Hassle-free online process

- Affordable loans

- Prompt feedback

- Reasonable APRs

- All credit scores considered

Eligibility for Bad Credit Car Loans with APRs Ranging from 5.99% to 35.99%

- At least 18 years old

- Proof of ID and address

- US citizen/resident

Fees on Bad Credit Car Loans

- Late payment fee

- 99% to 35.99% APR.

50K Loans: Best for Installment Loans for Bad Credit with Weekly, Fortnightly, and Monthly Repayments

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 8/10

- Variety of Products: 8/10

- Acceptance Rate: 8/10

- Customer Support: 7/10

50K Loans features a user-friendly platform that matches borrowers with non-traditional income to lenders with quick turnarounds, tailored terms, and flexible repayments.

Highlights of Installment Loans for Bad Credit

- User-friendly

- Borrow without a payslip

- Quick turnarounds

- Tailored terms

- Flexible repayments

Eligibility for Installment Loans for Bad Credit with Weekly, Fortnightly, and Monthly Repayments

- Proof of income via bank statements or tax returns

- Minimum age of 18

- ID proof

Fees on Installment Loans for Bad Credit

- Missed payment penalty

- 99% to 35.99% APR

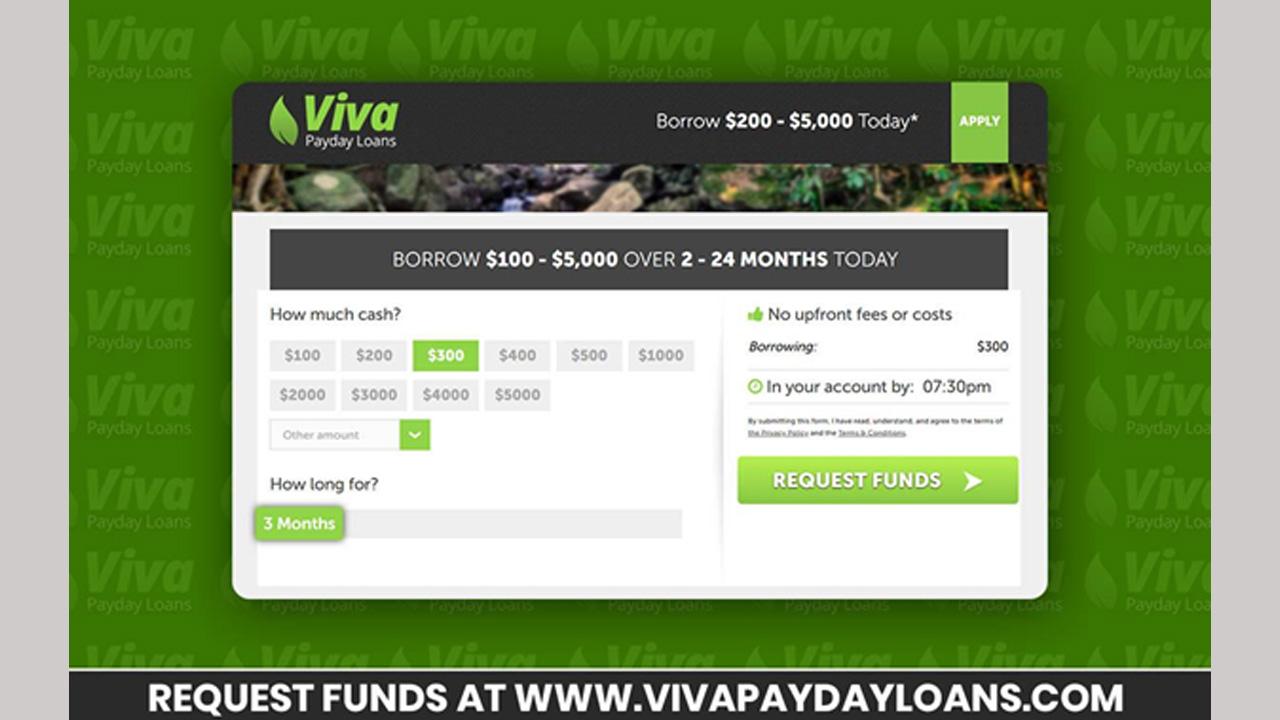

Viva Payday Loans: Best for Bad Credit Loans Guaranteed Approval Alternatives with Quick and Easy Online Application

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 8/10

- Variety of Products: 8/10

- Acceptance Rate: 7/10

- Customer Support: 8/10

With Viva Payday Loans, you can apply from anywhere through a quick and easy online process and get 2-minute feedback with swift payouts, even with bad credit.

Highlights of Bad Credit Loans Guaranteed Approval Alternatives

- Quick and easy online applications

- Apply from anywhere

- 2-minute feedback

- Swift payouts

- Borrow with bad credit

Eligibility for Bad Credit Loans Guaranteed Approval Alternatives with Quick and Easy Online Application

- 18 years and above

- Proof of steady income

- Legal US citizen

Fees on Bad Credit Loans Guaranteed Approval Alternatives

- APR from 5.99% to 35.99%

- Late payment penalty

How Did We Choose the Best Providers of Online Loans for Bad Credit?

We looked for providers offering:

- Quick online processes

- Inclusive terms

- Easy eligibility criteria

- Flexible amounts and repayments

Types of Online Loans for Bad Credit

No Collateral Loans with Bad Credit

These don’t require any valuable assets as security for approval and payout.

Student Loans with Bad Credit

Suitable when you need fast cash for further studies or school supplies.

Personal Bad Credit Auto Loans

Suitable for accessing financing to purchase a vehicle.

Bad Credit Auto Loans for Repairs

These can help you borrow quick cash for repairing your car.

Features and Factors of Personal Loans with Bad Credit

Speedy Payouts on Personal Loans with Bad Credit

Lenders are speedy with payouts and will disburse the approved amount as soon as possible.

Associated Costs of Personal Costs Bad Credit

Lenders can charge penalty fees for late or missed payments.

Reputation of Lenders Offering Personal Loans with Bad Credit

You’re only connected to licensed, honest, trustworthy lenders to guarantee peace of mind.

Repayment Options on Small Loans for Bad Credit

You can repay in 3 to 24 months through weekly, fortnightly, or monthly frequencies.

Top 5 Providers of Small Loans for Bad Credit

|

Best Small Loans for Bad Credit |

Pros |

Cons |

|

Green Dollar Loans |

Fast online process Inclusive lenders All income sources considered Fast approvals Quick payouts |

Pricey |

|

Heart Paydays |

Smooth online process Access specialized lenders Small to medium-sized loans Immediate feedback Quick disbursements |

Costly APR |

|

Big Buck Loans |

Hassle-free process Affordable loans Prompt feedback Reasonable APRs All scores considered |

Expensive |

|

50K Loans |

User-friendly Borrow without payslip Quick turnarounds Tailored terms Flexible repayments |

High fees |

|

Viva Payday Loans |

Quick and easy online applications Apply from anywhere 2-minute feedback Swift payouts Borrow with bad credit |

Pricey APR |

How to Apply for Bad Credit Personal Loans Guaranteed Approval $5000 and Other Loan Types

Follow these simple steps via the Green Dollar Loans platform:

Step 1: Choose the Term to Match Your Bad Credit Personal Loans Guaranteed Approval $5000 Loans and Other Loans

Select a suitable amount from $100 to $5000 and how long you need to repay from 3 to 24 months.

Step 2: Complete the Same Online Form for Car Loans for Bad Credit and Other Loan Types

Capture your details and submit the online form.

Step 3: Get Feedback on Car Loans for Bad Credit and Other Loan Types Within Minutes

You’ll get feedback within 2 minutes, and if you qualify, a lender will reach out and send you a loan contract. Read it carefully, then sign and return it.

Step 4: Expect Bad Credit Personal Loans to Payout Quickly

The lender will send the approved amount to your account as soon as possible.

FAQs About Loans for Bad Credit Online

How Do Bad Credit Loans Online Work?

These loans feature inclusive terms and allow you to access a lump sum after approval, then repay in easy installments.

How Are the Best Loans for Bad Credit Assessed?

Lenders assess more than your credit score and focus on your affordability instead of your credit issues.

How Can I Access Easy Loans for People with Bad Credit?

You can access easy loans for people with bad credit through loan providers who connect you to a lender likely to approve your application.

How Much Can I Borrow with Small Personal Loans for Bad Credit?

Depending on your affordability, you can borrow from $100 to $5,000.

How Can I Improve My Chances for Personal Loans for Bad Credit Instant Approval Alternatives?

You can improve your chances by choosing an affordable amount and providing accurate information in your application.

How Long Can I Repay Auto Loans for Bad Credit?

You can repay in 3 to 24 months through weekly, fortnightly, or monthly installments.

How Long Does Approval for Quick Loans for Bad Credit Take?

You can get approved within 2 minutes after submitting your application, provided you’re eligible and can afford repayments.

Conclusion

Green Dollar Loans is an excellent choice for accessing direct lenders offering bad credit loans from $100 to $5000 through a fast online process with 2-minute feedback, reasonable APRs from 5.99% to 35.99%, quick payouts, and flexible repayments from 3 to 24 months.

ALSO READ:

Disclaimer: The loan websites reviewed are loan-matching services, not direct lenders, therefore, do not have direct involvement in the acceptance of your loan request. Requesting a loan with the websites does not guarantee any acceptance of a loan. This article does not provide financial advice. Please seek help from a financial advisor if you need financial assistance. Loans available to US residents only.

Disclaimer: The views and opinions expressed in this sponsored article are those of the sponsor/author/agency and do not represent the stand and views of Mid-Day Group.Mid-Day Group disclaims any and all liability to any party, company or product for any direct, indirect, implied, punitive, special, incidental or consequential damages arising directly or indirectly from the use of this content.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!