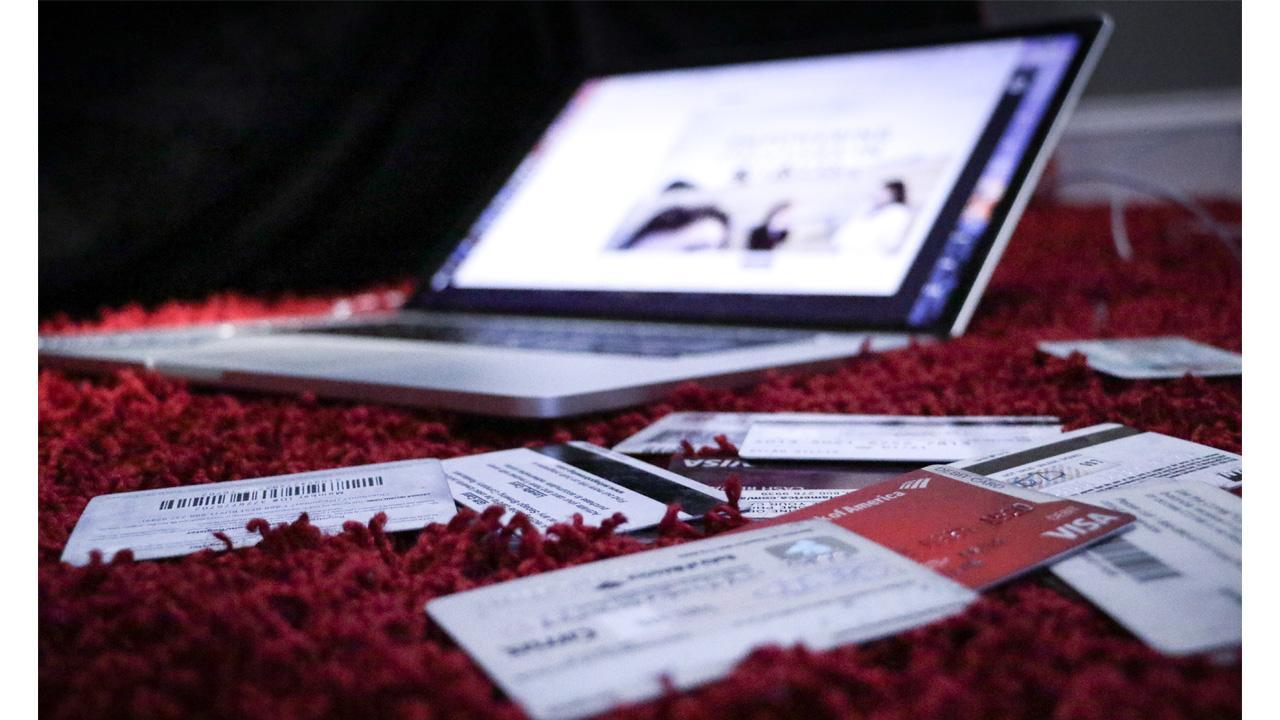

Financial institutions actively encourage individuals to maintain a healthy credit score. Knowing the importance of maintaining a healthy credit score is imperative if you wish to get a loan.

After all, your bureau score is one of the most crucial aspects of the eligibility criteria for availing instant Personal Loans.

ADVERTISEMENT

Credit score not only just applies to Personal Loans, but it is also included in the eligibility criteria for all types of loans such as Business Loans, Home Loan, Loan Against Property, Professional Loans, and Medical Equipment Loans etc..

Therefore, it is important to have a good credit score if you wish to avail yourself of any of the aforementioned credit instruments. In this blog, we will discuss 5 financial habits to ensure a healthy credit score.

What is a credit score?

Your credit score usually ranges between 300 and 900, which represents your credit history and credit habits. This number is derived based on your financial behaviour, credit mix, repayment patterns, and the number of times you have borrowed credit.

As per various credit bureaus operating in India, the following is the classification of credit scores. Please note that this classification should be considered as a thumb rule and not as a statutory range.

|

Credit score range |

Classification |

|

300-550 |

Poor |

|

550-620 |

Average |

|

620-680 |

Acceptable |

|

680-740 |

Good |

|

740-850 |

Excellent |

As mentioned above, your credit score is among the most important aspects that lenders check before approving your loan application. Today, various banks and Non-Banking Financial Companies (NBFCs) are offering online Personal Loans to cover unexpected and big-ticket expenses.

To qualify for these loans, it is important to have a healthy credit score. A good credit score will present you as a responsible buyer in the eyes of lenders, which, in turn, will ensure fast approval of your loan application. In addition to this, you might also get a lower interest rate on your instant Personal Loan.

Tips to help you maintain a good credit score

1. Make timely payments: - Making your EMI payments on time is the first and most important step for maintaining a healthy credit score. This not only improves your financial history and profile but also presents you as a reliable borrower. Missing out on EMI payments, or late payment of EMI adversely affects your credit score. Besides this, it might also attract penalties from the lender. Hence, ensure that you make timely payments during your loan tenure.

2. Check your credit report consistently: - Your credit report contains your entire financial history, credit-related information, and the status of your ongoing loans and their repayment procedure. If you have any errors in your credit report, it might hamper your credit score. Hence, make sure you keep checking your credit report from time to time and contact the bureau for rectification if you find any errors. In that way you will assess your personal loan eligibility.

3. Apply for loans only when you need them: - Each time you apply for a loan, the lender initiates a hard inquiry on your credit report. This brings down your credit score due to multiple enquiry. However, if you apply for multiple loans at once, lenders might perceive you as a borrower in desperate need of funds. In addition to this, too many hard inquiries will bring down your credit score. It is best to only apply for one credit instrument at a time.

4. Don’t overuse credit: - In case you have enough credit available on your credit cards, try not to use it all at once. Managing multiple credit instruments at the same time shows that you have your financial habits in place. This is beneficial especially when it comes to availing of instant Personal Loans. As these loans are unsecured, lenders are apprehensive about giving funds to borrowers as they would have nothing to recover in case of default. Hence, your financial habits and credit usage are important aspects that influence your loan approval and credit score.

Summing up

Good credit is a sign of having healthy financial habits. Remember, lenders consider your credit score for your loan request. Having a higher credit score will help you get approval for your loan applications faster. In addition to this, some lenders might also offer you attractive interest rates on your instant Personal Loan.

You can also use an online Personal Loan EMI calculator to determine your monthly repayment schedule. This way, you can manage your expenses effectively and leverage your instant Personal Loan to its potential.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!