These smartphone applications or mobile wallets that are helping the citizens of India survive during the ongoing money crunch and debate over demonetisation

Pic/YouTube

ADVERTISEMENT

Week after the Narendra-Modi led government announced ban on Rs. 500 and Rs 1000 notes, banks and ATMs across India are getting over crowded with people either to withdraw money or to exchange old notes. But, there are those who prefer to avoid the chaos outside banks and survive on their credit and debit cards.

After all, the smartphone era led to the introduction of mobile wallets, which is gradually turning the world towards cardless means of payment. These are some of those apps or mobile wallets that are helping the citizens of India survive during the ongoing money crunch and debate over demonetisation.

Pic/YouTube

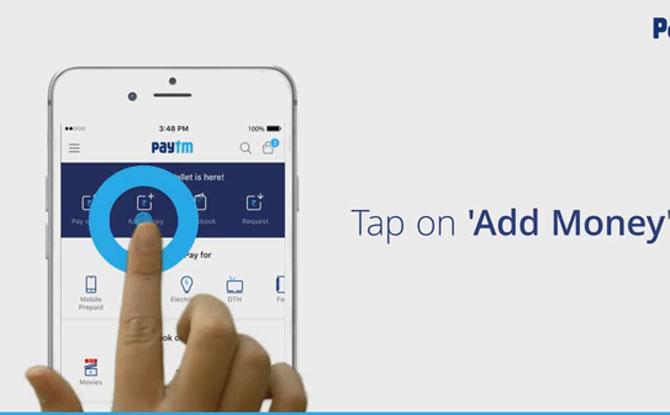

Paytm: It has a wide network of wallet partners including Uber, Foodpanda, Zomato, Grofers and Bookmyshow. Paytm initially started with mobile recharge, DTH plans and bill payments and later launched an e-commerce marketplace in 2014. Paytm is supposedly the only wallet that supports bookings on IRCTC. Once the wallet is topped by debit card, credit card or net banking, users can go ahead with cashless transactions anytime anywhere. From taking a Uber ride to ordering food from Zomato, Paytm has made common man’s life comfortable, even when our politicians are fighting over demonetisation.

PayU: It brought yet another revolutionary way to make payments online. Once PayU is installed in your smartphone and you fill it with adequate cash, there is no further need to remember debit or credit card details. PayU does not compromise on security of bank details including account number and bank passwords. PayU has partnered with Goibibo, Grofers, yatra.com, Myntra, Domino’s Pizza, Pepperfry and many such websites to provide a hassle free online shopping, food ordering or ticket booking. Instant refunds, 1% extra rewards point and assured delivery are some attractive benefits of PayU.

MobiKwik: This mobile wallet can be used for mobile recharge and any form of bill payment. Also, MobiKwik has partnered with merchants like BookMyShow, MakeMyTrip, Domino's Pizza, eBay. Not only online, MobiKwik has partnered with offline stores like Café Coffee Day, which in turn took cashless transactions one step further. While the government is fighting over note ban politics and hundreds of citizens are queuing outside banks and ATMS, those with MobiKwik wallet installed in their samrtphones, can enjoy the comfort of cashless paying and buying.

Freecharge: It helps you recharge prepaid mobile phones and pay postpaid mobile, electricity, DTH and internet bills from anywhere anytime. Top the wallet with debit card, credit card or internet banking and keep paying bills and recharging internet and phone connections. Freecharge actually saw a jump in profit a night after Modi-government declared ban on Rs. 500 and Rs. 1000 notes.

Pic/YouTube

Vodafone M-pesa: It is said to be India’s largest cashless network. The USP of Vodafone M-pesa is that it lets you send money to anyone. Apart from this, recharge of prepaid phone connections, DTH connections and payment of utility bills and posptaid mobile bills can also be done through M-pesa. So why run after liquid cash, when you can go cashless with a tap on your smartphone screen?

Ola Money: If you have the Ola cab application installed in your phone, then simply use or debit or credit card to transfer cash in Ola Money wallet. The wallet keeps your cash secured and every time you take Ola ride, the cab fare will get automatically deducted from the Ola wallet. Why to pay cash on hand when there is a chance to store in the Ola Money Wallet?

Airtel Money: Unlike the above mentioned ones, this is a semi-closed wallet. It can be used to make money transfers to contacts and bank accounts. Phone and utility bills recharge and online shopping can also be initiated through Airtel Money. Cash can be loaded in the wallet from any Airtel relationship centre or Airtel money outlet. Download the app, top up and go cashless.

Other wallets like Citrus Pay, Oxigen Wallet run on similar lines and ensure customers enjoy hassle- free cashless shopping. So, till you have a smartphone with these applications installed, you need not worry how to order a Domino’s pizza or how to book ticket for a Hollywood thriller?

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!